Thomas Gayner: Berkshire Hathaway’s new position in Markel

Listen to this episode from The World According to Boyar on Spotify. The Interview Discusses: The secret to success in the investment business.His investment thesis on both Home Depot &

You are here: Home || All posts

Listen to this episode from The World According to Boyar on Spotify. The Interview Discusses: The secret to success in the investment business.His investment thesis on both Home Depot &

Many interesting reflections from Michael Mauboussin, focusing on three main themes: – Return on invested capital (ROIC) – Assessing a company’s competitive advantage – Management’s ability to invest the company’s

Mouboussin gives us an insight into his extremely well-equipped toolbox. He covers both classic investment topics with references to Buffett and Graham and takes the reader on a wide range of topics such as casino gambling, psychology, horse racing and evolutionary biology.

With an investment of a large, triple-digit million DKK amount in the Danish renewable energy company Better Energy, ATP makes one of the largest investments of the year. The investment is part of ATP’s ambition to strengthen the development of green, Danish-produced energy and contribute to the green transition.

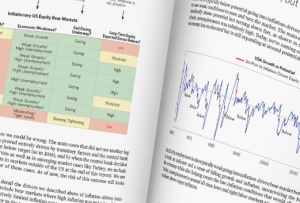

What does it take for us to typically see a bottom? The American hedge fund Bridgewater recently published an interesting report on the current market situation. Here they analyze whether

Mathematically correct price level In First Eagle’s latest letter to shareholders, they provide their assessment of the current market. Due to recent interest rate hikes by the world’s central banks,

The least important thing… In an interview with St. Jame’s Place, Howard Marks of Oaktree talks about his approach to investing. Marks is the author of the excellent book, “The

In his latest letter to shareholders, Oakmark CIO Bill Nygren writes about the difficult situation many investors find themselves in. His starting point is American investors, but the points are

Smart investors will always take money from the less smart In an entertaining interview with the London School of Economics, Ray Dalio explains why it’s possible for investors to beat

The time has come to start buying up In an interview with Interactive Investor, Bill Ackman of Pershing Square Holdings shares his views on the market at the end of