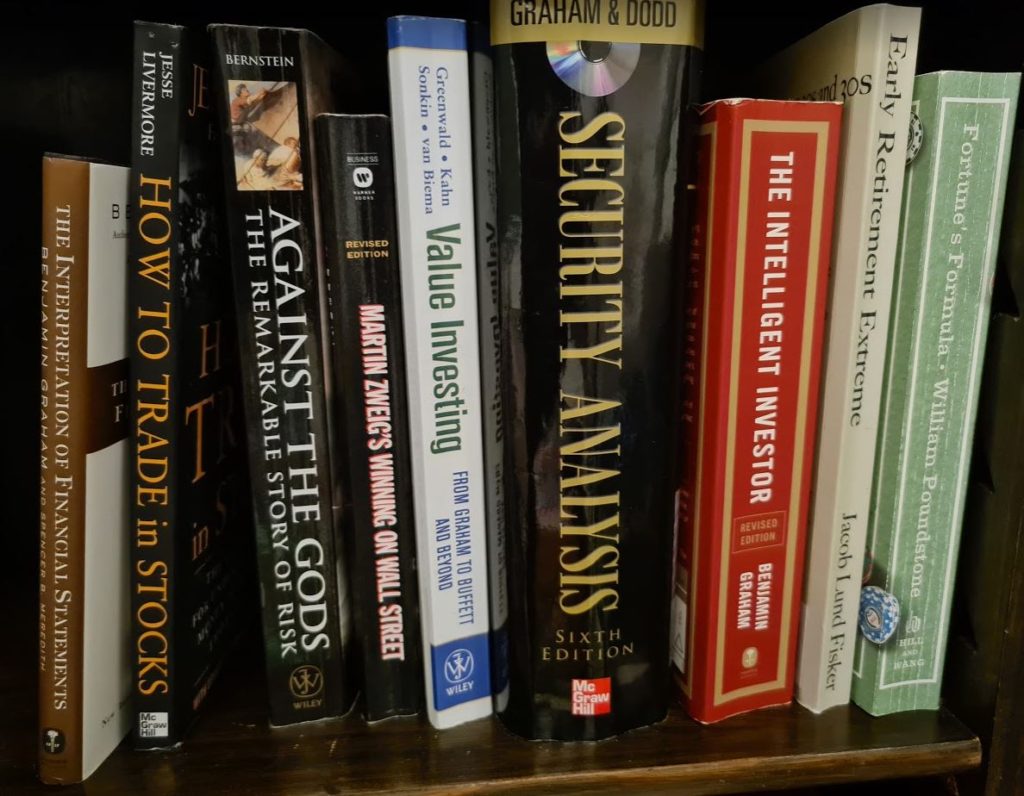

On this page, I have compiled my list of the best investment books written over the last 100 years. The books provide a unique insight into the topic they cover and only the best are included on the list.

If you think a book is missing, leave a comment at the bottom of the page. I can’t promise it will be on, but it’s always good to have new ideas (!)

If you’re looking for a short list of the very best, check out my list of the top 5 investment books.

“In my whole life, I have known no wise people – over a broad subject matter area – who didn’t read all the time. None, zero.”

– Charlie Munger, Vice Chairman Berkshire Hathaway

| ID_boeger | Priority | Title | Author | Category | Sub-category | Published | Amazon rating | Why read it? |

|---|---|---|---|---|---|---|---|---|

| 84 | 1 | Competition Demystified: A Radically Simplified Approach to Business Strategy | Bruce Greenwald | On our reading list | Det skal jeg læse | 2007 | 4.6 | Standing on the shelf and waiting - then comes a description |

| 85 | 1 | Consillience: The Unity of Knowledge | Edward O. Wilson | On our reading list | Det skal jeg læse | 1999 | 4.5 | Standing on the shelf and waiting - then comes a description |

| 86 | 1 | The Innovators Solution: Creating and Sustaining Successful Growth | Clayton Christensen, Raynor | On our reading list | Det skal jeg læse | 2013 | 4.5 | Standing on the shelf and waiting - then comes a description |

| 87 | 1 | Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail | Ray Dalio | On our reading list | Det skal jeg læse | 2021 | 4.6 | Standing on the shelf and waiting - then comes a description |

| 88 | 1 | Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett The Worlds | Mary Buffett | On our reading list | Det skal jeg læse | 1999 | 4.6 | Standing on the shelf and waiting - then comes a description |

| 89 | 1 | Expectations investing: Reading Stock Prices for Better Returns, Revised and Updated | Michael J. Mauboussin, Alfred Rappaport | On our reading list | Det skal jeg læse | 2021 | 4.4 | Standing on the shelf and waiting - then comes a description |

| 90 | 1 | Den Rationelle Investor: Få succes med langsigtede valueaktier | Kurt Kara | On our reading list | Det skal jeg læse | 2016 | 0.0 | Standing on the shelf and waiting - then comes a description |

| 91 | 1 | The Interpretation of Financial Statements: | Benjamin Graham | On our reading list | Det skal jeg læse | 1998 | 4.6 | Standing on the shelf and waiting - then comes a description |

| 26 | 8 | I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6Week Program That Works | Ramit Sethi | FIRE | FIRE | 2019 | 4.5 | Many practical guides and advice on everything from negotiating a better salary to investing long -term. A bit American in its approach, but has many low -practical points, which are also relevant globally and here in DK. |

| 27 | 3 | The Richest Man in Babylon | George S. Clason | FIRE | FIRE | 1927 | 4.7 | A classic that is highly recommended. Short and easy to read with many timeless advice on private economy. |

| 28 | 4 | Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! | Robert T. Kiyosaki | FIRE | FIRE | 2012 | 4.7 | An entertaining tale of the value of money and why some people get financial success in life while others are struggling throughout. |

| 29 | 6 | The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life | JL Collins | FIRE | FIRE | 2017 | 4.7 | As the title shows, Collins shows us a simple and understandable path to financial freedom. Down -to -earth and practical model for Financial Independence, Retire Early (Fire) |

| 30 | 2 | Your Money or Your Life: 9 Steps to Transforming Your Relationship with Money and Achieving Financial Independence | VIcki Robin | FIRE | FIRE | 2008 | 4.4 | A practical and inspiring approach to money and financial freedom. For me, one of the crucial books in my own journey towards becoming financially independent. Highly recommended. |

| 31 | 5 | The Millionaire Next Door: The Surprising Secrets of America's Rich | Thomas J. Stanley | FIRE | FIRE | 2010 | 4.7 | An interesting and fact-based tale of who the typical dollar millionaire is and how they come there. |

| 32 | 1 | Think and Grow Rich : The Landmark Bestseller Now Revised and Updated for the 21st Century | Napoleon Hill | FIRE | FIRE | 2007 | 4.7 | In my view a true classic that many more should enjoy. The book is based on Napoleon Hill's interview with over 500 very successful Americans, including Rockefeller, Edison, Ford and three US presidents. Based on his research, 13 steps are reviewed to achieve the same success. |

| 63 | 9 | Early Retirement Extreme: A Philosophical and Practical Guide to Financial Independence | Jacob Lund Fisker | FIRE | FIRE | 2010 | 4.3 | One of the 'gurus' in financial Independence Retire Early (Fire) is pure actually Dane. His name is Jacob, lives in the US and has managed to take the most extreme approach to the concept. Even for us who are not quite as hard core as Jacob, there are many things to learn. |

| 64 | 7 | Enough: True Measures of Money, Business, and Life | Jack Bogle | FIRE | FIRE | 2010 | 4.5 | The founder of Vanguard and the first index funds in the world gives his perspectives on investment, running a business and life. |

| 16 | 1 | The Complete TurtleTrader: How 23 Novice Investors Became Overnight Millionaires | Michael W. Covel | Inspiration | Biografier | 2007 | 4.4 | The fascinating story of Wall Street legend Richard Dennis and his disciples "The Turtles", who learned to earn millions of technical analysis without any background in investment. |

| 17 | 1 | Market Wizards: Interviews with Top Traders | Jack D. Schwager | Inspiration | Biografier | 2012 | 4.8 | Collection of interviews with many of the biggest legends on Wall Street such as Paul Tudor Jones and Bruce Kovner. For more inspiration, the other books in the series are also recommended: "Hedge Fund Market Wizards" and "New Market Wizards" and "Unknown Market Wizards" |

| 18 | 1 | The Complete Financial History of Berkshire Hathaway: A Chronological Analysis of Warren Buffett and Charlie Munger's Conglomerate Masterpiece | Adam J. Mead | Inspiration | Biografier | 2021 | 3.7 | For those who just can't get enough knowledge of Berkshire and the two legends behind: Warren Buffett and Charles Munger. A very detailed review of the company - even for those who know the story. |

| 19 | 1 | Investment Biker: Around the World with Jim Rogers | Jim Rogers | Inspiration | Biografier | 1994 | 4.5 | The legendary investor talks about his extremely extreme motorcycle trip around the Earth and his hunt for investments in new markets. For someone who himself has run a motorcycle, the book was a fascinating tale. |

| 20 | 1 | Richer, Wiser, Happier: William Green | William Green | Inspiration | Biografier | 2021 | 4.8 | Green has spent 25 years following and interviewing many of the biggest investors over time. In the book we gain insight into the thoughts of a number of highly recognized such as Warren Buffett, Howard Marks and John Templeton |

| 21 | 1 | What It Takes: Lessons in the Pursuit of Excellence | Stephen A. Schwarzman | Inspiration | Biografier | 2019 | 4.6 | Schwarzman, Chairman, CEO and Co-Founder of Blackstone, tells its story and the critical elements that helped create the world's largest investment company. Many interesting reflections on starting and building a company from culture to risk management. |

| 22 | 1 | The Man Who Solved the Market | Gregory Zuckerman | Inspiration | Biografier | 2019 | 4.5 | Exciting insight into the otherwise very closed Hedge Foundation, Renaissance Technologies. We hear about Simon's own background and Renaissance mathematical and disciplined approach to the markets. |

| 23 | 1 | Reminiscences of a Stock Operator | Lefevre Edwin | Inspiration | Biografier | 1923 | 4.5 | Despite its 100th anniversary since its release, it is still an entertaining and easy -to -read story about being Stock Operator back when the stock exchange was physical. Many topics are still relevant today. |

| 24 | 1 | The Education of a Value Investor | Guy Spier | Inspiration | Biografier | 2014 | 4.6 | A very honest and insightful story told by the man himself. Excellent book about one of the most insightful value investors of our time and he travels from short -term and self -absorbed to long -term and generous. A book that made a big personal impression. |

| 25 | 1 | The Warren Buffett Way | Robert Hagstrom | Inspiration | Biografier | 2013 | 4.7 | One of the best biographies about Warren Buffet. The book provides a good description of Buffett's innovative investment and business strategies. |

| 33 | 1 | The Fall and Rise of China: The Great Courses | Richard Baum | Inspiration | Historie | 2013 | 4.8 | Looking for a historical review and a better understanding of China and Chinese culture, this is an excellent place to start. Professor Baum tells through 48 lessons about all of China's history. |

| 34 | 1 | The Price of Tomorrow: Why Deflation Is the Key to an Abundant Future | Jeff Booth | Inspiration | Økonomi | 2020 | 4.7 | In a time when inflation is increasing for the first time in decades, it is exciting with booth's reflections on deflation as a key to many of our global challenges |

| 35 | 1 | Range: How Generalists Triumph in a Specialized World | David Epstein | Inspiration | Mental models | 2019 | 4.6 | The path to success is often through a broad knowledge across disciplines. |

| 36 | 1 | The Great Mental Models: General Thinking Concepts | Shane Parrish | Inspiration | Mental models | 2019 | 4.3 | Introduction of nine mental models to improve your decision -making process, productivity and how to view the world. |

| 37 | 1 | Presuasion | Robert Cialdini | Inspiration | Psykologi | 2020 | 4.4 | The sequel on Professor Cialdini First Book, Influence. In pre-suasion, the focus is on the many factors that subconsciously influence our decisions and how you can make use of them to achieve your own goals. |

| 38 | 1 | Where Are the Customers' Yachts?: Or A Good Hard Look at Wall Street | Fred Schwed | Inspiration | Økonomi | 2006 | 4.5 | A classic in the investment world - and a much needed look at Wall Street and why it is to investors and knocking always earning well |

| 39 | 1 | More Than You Know: Finding Financial Wisdom in Unconventional Places | Michael J. Mauboussin | Inspiration | Mental models | 2006 | 4.2 | The book is a true gold mine of practical tools to improve your way of making investment decisions. The book is aimed at anyone who wants to expand their horizon and get an introduction to the many relevant disciplines of relevance for investment. Read our Key Takeaways here. |

| 40 | 1 | Sapiens | Yuval Noah Harari | Inspiration | Historie | 2011 | 4.7 | A fascinating tale of humanity's history through millennia. Harari explores who we are, how we got here and where we are going. Investors are also people (have I been told). |

| 41 | 1 | Skin in the Game: Hidden Asymmetries in Daily Life | Nassim Nicholas Taleb | Inspiration | Risikostyring | 2018 | 4.3 | An insight into the benefits of aligning incentive and goals among different stakeholders. And a lot of other reflections about having 'something at stake'. |

| 42 | 1 | Start with Why: How Great Leaders Inspire Everyone to Take Action | Simon Sinek | Inspiration | Psykologi | 2011 | 4.6 | Tells the story of how some leaders manage to influence large parts of the world by focusing on the cause. If you are an entrepreneur, the book is not to be avoided. |

| 43 | 1 | Irrational Exuberance | Robert J. Shiller | Inspiration | Økonomi | 2020 | 4.4 | Interesting introduction to Shiller's reflections on valuation and what drives the market's sometimes irrational pricing. Posted by Yale Professor Shiller - is one of the most recognized academics for the past several decades. |

| 44 | 1 | How to Win Friends & Influence People: The Only Book You Need to Lead You to Success | Dale Carnegie | Inspiration | Psykologi | 1998 | 4.7 | A classic with practical advice on how to make others better, your way of thinking and getting them into your ideas. Warren Buffet stated years ago "The Dale Carnegie Course Changed My Life." |

| 45 | 1 | Principles: Life and Work | Ray Dalio | Inspiration | Personlig udvikling | 2017 | 4.6 | A unique insight into the principles that have made Dalio one of the most successful hedge finders. Told by the man himself and with a practical approach that can be used by all of us. |

| 46 | 1 | Unshakable | Tony Robbins | Inspiration | Personlig udvikling | 2017 | 4.6 | Tony Robbins are ways too much. At the same time, you just have to take the hat off for his insight and approach to personal development. The book offers a ranks of strategies to achieve financial freedom and investment in the stock market. |

| 47 | 1 | Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets | Nassim Nicholas Taleb | Inspiration | Risikostyring | 2005 | 4.5 | In my opinion the best of Taleb's books. Here he gives us a unique insight into difficult topics such as the importance of risk, luck and abilities. |

| 48 | 1 | The Black Swan: The Impact of the Highly Improbable | Nassim Nicholas Taleb | Inspiration | Risikostyring | 2010 | 4.5 | Black swans are not a normal sight in Danish lakes, but that does not necessarily mean that they do not exist. Excellent presentation of the great importance of unlikely - but very essential - events and their effect on the world and our stock portfolios. |

| 49 | 1 | The Failure of Risk Management: Why It's Broken and How to Fix It | Douglas W. Hubbard | Inspiration | Risikostyring | 2020 | 4.5 | A much necessary criticism of modern (qualitative) risk management and methods of addressing the challenges. The book promotes a static and evidence -based approach to risk management, as known from, for example, the actuary/insurance world. |

| 50 | 1 | Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger | Peter D. Kaufman | Inspiration | Personlig udvikling | 2005 | 4.8 | Kaufman has collected the very best speeches, posts and other sources from one of the biggest and most intelligent investors of all time, Berkshire Hathaways' Vice Chairman Charlie Munger. The book is a beautiful release with a lot of pictures and illustrations throughout. It really deserves a place on the shelf of all serious investors. |

| 52 | 1 | 10 1/2 Lessons From Experience: Perspectives on Fund Management | Paul Marshall | Inspiration | Økonomi | 2020 | 4.2 | A short and easy -to -read book about the many psychological fall groups that both professional hedge funds and private individuals must take care of. |

| 53 | 1 | Fortune's Formula: The Untold Story of the Scientific Betting System That Beat the Casinos and Wall Street | William Poundstone | Inspiration | Risikostyring | 2006 | 4.5 | The fascinating story of two scientists' drive to beat the casinos. Particularly interesting for investors because it so excellently explains what it means to have an edge and the many benefits - and disadvantages - that a mathematical approach to betting can have. |

| 54 | 1 | Misbehaving: The Making of Behavioral Economics | Richard Thaler | Inspiration | Psykologi | 2016 | 4.6 | Richard Thaler won the Nobel Prize for his work with Behavioral Economics and tells in the book about the development of the new field - the human side of economy. He links psychology with practical understanding of incentives and the stock market with the aim of giving the reader a better understanding of his own limitations. |

| 55 | 1 | Superforecasting: The Art and Science of Prediction | Philip Tetlock, Dan Gardner | Inspiration | Risikostyring | 2016 | 4.5 | Wharo -Professor Philip Tetlock, in his 2005 study, showed how even the most respected experts' predictions are only minimally better than flat or crown. Still, there is a small group of experts who continuously the purpose of making quite precise predictions. The book delves into the characteristics that enable these experts to live up to their name. |

| 56 | 1 | Antifragile: Things That Gain from Disorder | Nassim Nicholas Taleb | Inspiration | Risikostyring | 2012 | 4.5 | In Black Swan, the speechb describes the challenges of unlikely events with great consequence. In Antifragile, he gives his offer for a solution. In the book he tries to find different elements and systems that become stronger from being exposed to 'shock' or shock - just think of human bones. Despite its slightly dry subject, Taleb is entertaining as always. |

| 57 | 1 | Thinking, Fast and Slow | Daniel Kahneman | Inspiration | Psykologi | 2011 | 4.6 | If you only need to read one book about psychology, then Kahneman's classic is probably the place to start. Infinite insightful, easily understandable and focus on topics of relevance to investors. Not surprisingly, he was the first psychologist to win the Nobel Prize in Economics. |

| 58 | 1 | The Halo Effect: and the Eight Other Business Delusions That Deceive Managers | Phil Rosenzweig | Inspiration | Ledelse | 2014 | 4.4 | A relevant tale of the many pitfalls that exist when studying companies. One of the most prominent is the 'glory effect' that the most successful companies have. Their excellent business results lead to a conclusion that management, strategy, execution, etc. is similarly excellent. Right until the business results are no longer there and all the other properties at the same time turn out not to be durable. |

| 62 | 1 | Manias, Panics, and Crashes: A History of Financial Crises | Robert Z. Aliber | Inspiration | Historie | 2015 | 4.3 | If you only need to read one book about the story in the stock market, this classic is the right choice. Published in no less than 7 versions over the years. Get perspective on the present to study the past. |

| 68 | 1 | How To Trade In Stocks | Jesse Livermose | Inspiration | Biografier | 1940 | 4.6 | A unique insight into the life and method of one of the most successful traders of all time. And his hardship and fall. The book comes around reading a market, analyzing sectors, the time market and managing one's emotions. |

| 73 | 1 | Against The Gods: The Remarkable Story of Risk | Peter L. Bernstein | Inspiration | Risikostyring | 1998 | 4.4 | If you work with risk management or you just have interest in topics, the book is a true gold mine. We get a historical review of topics right up to our time and with the discussion of the tools we have today for risk management. |

| 75 | 1 | A Short History of Financial Euphoria | John Kenneth Kenneth Galbraith | Inspiration | Historie | 1994 | 4.5 | As the title suggests a brief and easy -to -read book about the most spectacular episodes of our economy over the past three centuries. |

| 77 | 1 | The Snowball: Warren Buffett and The Business of Life | Alice Schroeder | Inspiration | Biografier | 2008 | 4.6 | Schroeder has had a truly unique access to interview Warren Buffett, his immediate family, friends and business contacts. All for the purpose of conveying the full story of "The Oracle of Omaha". We come all the way around and the book covers both strengths and weaknesses, giving an exciting insight into Buffett's basic philosophy. A bit long, but at the same time a deep insight into the man behind. |

| 78 | 1 | Damn Right!: Behind the Scenes with Berkshire Hathaway Billionaire Charlie Munger | Janet Lowe | Inspiration | Biografier | 2003 | 4.6 | An exciting insight into the person and the story behind Charlie Munger, Berkshire Hathaway's Vice Chairman and Warren Buffett's partner throughout the years. |

| 79 | 1 | Zero to One: Notes On Startups, or How To Build The Future | Peter Thiel | Inspiration | Iværksætter | 2001 | 4.6 | Many startups take something we already have or know and do better. You take it from 1 to n. But we manage to create something real new we go from 0 to 1. Peter Thiel draws on his experience from his own startups such as Paypal and Palantir as well as its many investments in Silicon Valley Startups such as Facebook and SpaceX to Learn the reader where you build or invest in successful startups. |

| 1 | 17 | The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness | Morgan Housel | Investing | Grundbog | 2020 | 4.7 | As the title indicates a review of our human psychology in the context of investment and money. A really good eye opener for new investors. |

| 2 | 21 | The Little Book of [Title]: How to Value a Company, Pick a Stock and Profit | Flere forfattere | Investing | Grundbog | 2006 | 4.6 | The whole "The Little Book" series is absolutely excellent. Written by many of the best authors in their own field, they tell in 'Pixi format' about many relevant topics. They are short, easily accessible and very compressed knowledge of their respective topics. In particular, the books The Litte Book ... "That Still Beats The Market", "Of Value Investing", "Of Valuation" and "Of Common Sense Investing". |

| 3 | 31 | Learn to Earn: A Beginner's Guide to the Basics of Investing and Business | Peter Lynch, John Rothchild | Investing | Grundbog | 1996 | 4.7 | A simple and easily accessible guide to learning about the stock market and how to best invest in specific companies |

| 4 | 23 | Winning the Loser's Game: Timeless Strategies for Successful Investing | Charles D. Ellis | Investing | Grundbog | 2021 | 4.5 | Get help from one of the fighters in the investment world to build your personal investment goals, and a realistic and index -based way of reaching them. |

| 5 | 9 | Stocks for the Long Run: The Definitive Guide to Financial Market Returns & LongTerm Investment Strategies | Jeremy Siegel | Investing | Grundbog | 2022 | 4.6 | Excellent basic book with introduction to value investment, risk investment risks and in 2022 expanded with current topics such as sustainable investment (ESG). |

| 6 | 25 | One Up On Wall Street: How To Use What You Already Know To Make Money In The Market | Peter Lynch | Investing | Grundbog | 1999 | 4.7 | An easily understandable and practical introduction to the art of investing in shares. Take the products and services you see in your everyday life and invest in the companies that produce them and offer a sensible balance between risk and return. |

| 7 | 12 | What Works on Wall Street | James P. O'Shaughnessy | Investing | Grundbog | 2016 | 4.5 | Excellent and classic basic book to understand the market ups and downs. Understand the various investment strategies and the most important rations such as EBITDA to Enterprise Value. |

| 8 | 30 | The Big Secret for the Small Investor: The Shortest Route to LongTerm Investment Success | Joel Greenblatt | Investing | Grundbog | 2011 | 4.2 | A brief and highly accessible introduction to investment for private investors. Provides insight into how the markets, the distinction between value and price of a company and what works is happening on Wall Street. |

| 9 | 11 | Common Stocks and Uncommon Profits: And Other Writings | Philip A. Fisher | Investing | Grundbog | 1958 | 4.6 | Fisher is widely recognized as one of the most influential investors ever. Despite its many years in the back, the book is still a fascinating insight into the art of making 'buttom up' investment with analysis of specific companies. |

| 10 | 26 | Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated | David F. Swensen | Investing | Avanceret | 2009 | 4.3 | David Swensen has been at the forefront of Yale University's "Endowment" for decades, where he has beaten the market by a wide margin. In the book, Swensen reviews its unconventional approach and what approaches that others can - and just as important - cannot learn from and use. |

| 11 | 19 | Mastering the Market Cycle: Getting the Odds on Your Side | Howard Marks | Investing | Avanceret | 2018 | 4.4 | Learn to identify the different ups and downs of the market and learn to exploit them in your favor. |

| 12 | 24 | The Manual of Ideas: The Proven Framework for Finding the Best Value Investments | John Mihaljevic | Investing | Avanceret | 2013 | 4.0 | Introduces the reader to a value / fundamental framework to identify, analysis and prioritize investment ideas. |

| 13 | 22 | Pitch the Perfect Investment: The Essential Guide to Winning on Wall Street | Paul D. Sonkin, Paul Johnson | Investing | Avanceret | 2017 | 4.3 | An all-in-one guide to those who want a career as a research analysis or equity analyst in a bank or investment fund. Learn to pitch an investment idea and build a case for a given company. |

| 14 | 18 | The Acquirer's Multiple: How the Billionaire Contrarians of Deep Value Beat the Market | Tobias E. Carlisle | Investing | Avanceret | 2017 | 4.6 | Provides an insight into how legendary investors such as Warren Buffett invest. Presents a quantitative model with nine rules to build a 'deep value' portfolio. |

| 15 | 10 | The Alchemy of Finance | George Soros | Investing | Avanceret | 2001 | 4.3 | Fascinating insight into investment legend Soros' thinking. Here is a person whose ability to 'think outside the box' has made him one of the most successful investors over time if the Hedge Foundation can move entire markets. |

| 51 | 3 | Margin of Safety: Riskaverse Value Investing Strategies for the Thoughtful Investor | Seth A. Klarman | Investing | Avanceret | 1991 | 4.5 | An excellent - if not the best - book about value and risk oriented investment. The message simple: Uncover all the potential risks of given investment and minimize the possibility of losing money. Then the upside should probably come by itself. Written by one of our most successful hedge Fund Managers, Seth Klarman. The book is difficult to get hold of and must typically be purchased use (for a very considerable amount). However, can sometimes be found online in PDF if you are a little creative. |

| 59 | 5 | Value Investing: From Graham to Buffett and Beyond | Bruce Greenwald, Judd Kahn | Investing | Avanceret | 2020 | 4.6 | If you are looking for the ultimate basic book to learn fundamental valuation of a company, you have found the right one. Columbia Professor Bruce Greenwald builds on the Value Investing principles from Benjamin Graham and expands with methods to also value growth companies. Despite its upland, the book is deliberately kept low practical and with many examples. A classic for more serious investors. |

| 60 | 7 | The Dhandho Investor: The LowRisk Value Method to High Returns | Mohnish Pabrai | Investing | Grundbog | 2007 | 4.7 | An entertaining, easily accessible and very practical book on value investment. Indian Monish Pabrai focuses on the individual investor who wants to invest with the least possible risk and the highest possible return. Or as Pabrai would say "Heads, I Win! Tails, I Don't Lose Much!". His approach get investments, big investments and rare investments - in other words: Games when you have a hand that pretty much never loses and rate big. |

| 61 | 6 | The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor | Howard Marks | Investing | Grundbog | 2013 | 4.6 | An exciting re -release of Howard Mark's classic. Now with comments from many of the most knowledgeable investors, giving even more perspective on the already excellent reflections and perspectives. |

| 65 | 8 | Security Analysis | Benjamin Graham, David Dodd | Investing | Avanceret | 1934 | 4.7 | The Bible in Value Investing and the first book on fundamental valuation of companies. Despite the book's many years on the back, reading Graham and Dodd's analysis of companies is still fascinating. The only way they access the analysis is interesting - even if some that the specific ratios are not in all cases fully applicable to all companies today (just think the change from material to intangible assets). |

| 66 | 1 | The Intelligent Investor | Benjamin Graham | Investing | Grundbog | 1949 | 4.7 | The ultimate classic about fundamental investment. The book was written with the private investor in focus and it makes it easily accessible and pragmatic. If you only need to read one investment book in your life, this is a really good bid. |

| 67 | 20 | You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits | Joel Greenblatt | Investing | Grundbog | 1999 | 4.5 | An easily accessible introduction to what Greenblatt calls "special situation", eg spin-offs (cleavage of company), reconstructions, merger and bankruptcy. These situations are not part of a company's normal operation and typically have built -in complexity. But with this complexity there are also opportunities for investors who have the time and the ability to get into the situation. |

| 69 | 29 | Beating the Street | Peter Lynch | Investing | Grundbog | 1994 | 4.6 | Lynch presents his 'do-it-yourself' method of becoming an expert in a specific company and learning how to build his own investment portfolio. Easily accessible and with a 'step-by-step' strategy to select shares. |

| 70 | 2 | A Random Walk Down Wall Street: The Best Investment Guide That Money Can Buy | Burton G. Malkiel | Investing | Grundbog | 2023 | 4.6 | Malkiel's book is one of the best basic books about the art of investing. It provides the necessary knowledge to understand the financial markets, shares, index funds and an excellent framework for building one's own portfolio. In the latest edition from 2023 there are also chapters on new relevant topics such as factor and ESG investment. |

| 71 | 13 | Quantitative Momentum: A Practitioner's Guide to Building a MomentumBased Stock Selection System | Wesley R. Gray, Jack R. Vogel | Investing | Avanceret | 2016 | 4.2 | Quite an excellent basic book in Momentum Investment - a systematic investment strategy based on price (share price). We learn what momentum is and is not, why Momentum can beat the market and a practical strategy to implement the strategy yourself. |

| 72 | 14 | The Aggressive Conservative Investor | Martin J. Whitman, William Shubik | Investing | Avanceret | 2005 | 3.7 | A classic first published in 1979, when the authors explain value investment technique to invest in crisis -affected companies. We learn to analyze and assess shares completely as owners with control over the company. The authors use a lot of case studies, which are good learning but also require experience and time for immersion. |

| 74 | 32 | Den Tålmodige Investor | Helge Larsen | Investing | Grundbog | 2018 | 0.0 | Short, easily accessible and yet an excellent introduction to the art to invest if it is to be in Danish. |

| 76 | 4 | The Essays of Warren Buffett: Lessons for Corporate America | Cunningham | Investing | Avanceret | 2019 | 4.7 | Although Buffett has never published a book himself, he has written a lot over time in his letters to Berkshire Hathaway's shareholders. Now Professor Lawrence Cunningham - with acceptance and sparring from Warren Buffet himself - has assembled the best passages categorized by topic. An excellent and easily accessible entrance to Buffett's most important pointers over time. |

| 80 | 27 | The Motley Fool Investment Guide: How the Fool Beats Wall Street's Wise Men and How You Can Too | David Gardner, Tom Gardner | Investing | Grundbog | 2001 | 4.1 | An excellent book if you are a private investor and want a practical and easily accessible introduction to equity investment as well as a deeper understanding of growth companies. The weight of the book is rightly placed in the two authors' frameworks to find and analyze companies, called “An Everlasting Approach to Investing” (Tom) and “Breaking the Investment Rules” (David). The fact that many passages are at the same time written with a twinkle in the eye only makes the reading experience better. Read our key take-aways from the book. |

| 81 | 28 | The Four Pillars of Investing: Lessons for Building a Winning Portfolio | William Bernstein | Investing | Grundbog | 2010 | 4.6 | Excellent basic book to learn about investment and build your own portfolio with the relevant asset classes. |

| 82 | 15 | The Templeton Way: The Market Beating Strategies of Value Investing's Legendary Bargain Hunter | Lauren Templeton, Scott Phillips | Investing | Grundbog | 2008 | 4.6 | Templeton was a legend on Wall Street and known for its international approach to value investment. He invested in sectors and geographies when everyone else had given up. It gave him excellent results over many decades. The book provides a practical review of Templeton's investment strategy and quantitative approach. |

| 83 | 16 | Competitive Advantage: Creating and Sustaining Superior Performance | Michael E. Porter | Investing | Avanceret | 1998 | 4.6 | On a true management classic where Porter introduces the concept of the value chain in companies and not least the elements of the chain that constitute a company's competitive advantage. According to Porter, there are two ways to differentiate to its competitors: lower costs or differentiation. The book is quite comprehensive, so if you need to prioritize, chapters 1-4 are recommended. |

| Priority | Title | Author | Category | Sub-category | Published | Why read it? |