In his latest letter to shareholders, Oakmark CIO Bill Nygren writes about the difficult situation many investors find themselves in. His starting point is American investors, but the points are absolutely relevant for Danish investors as well.

The starting point for the article is an inquiry from one of his customers who is retired and therefore lives off his investments. For many pensioners (and pension funds), 2022 has been a particularly difficult year. Investors have been hit by both falling stock prices and falling bond prices at the same time. The S&P 500 is down around 25% for the year and 20-year US Treasuries are down around 30%. This means that a normal 60/40 stock/bond portfolio is down more than a pure stock portfolio. It’s not an everyday occurrence – especially if you’re a retiree who has to live off your investments.

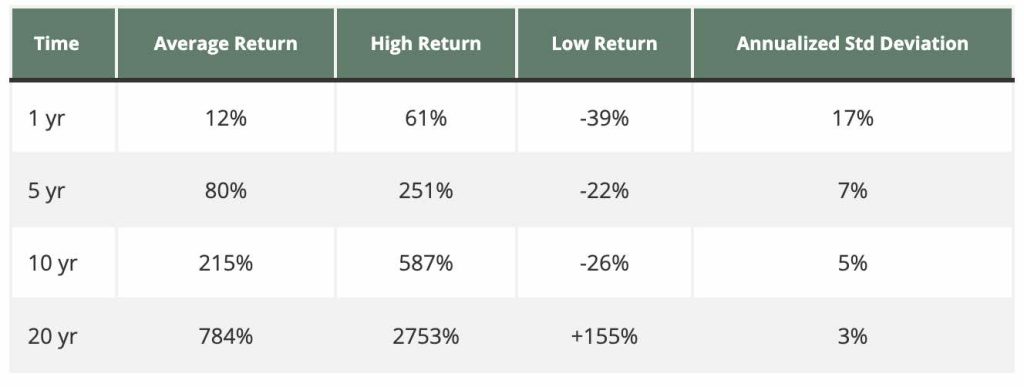

To give his client – and all of us – some perspective, Bill Nygren shows the table below for the average 1-, 5-, 10- and 20-year returns for the S&P 500 over the past 77 years, as well as the best and worst returns for each period:

The main take-away from the table is how much of a difference the time perspective makes. If the time horizon is one year (first line), we as investors can expect an average return of 12%, but we risk a loss of 39%. However, if you can wait five years, the average return is 80% and the worst case scenario is a 22% loss. These are odds worth betting on.

If we then look at a 20-year time horizon, the worst-case scenario is a doubling of your money and on average we more than 7 times our investment(!). The time perspective makes all the difference.

Bill Nygren concludes with the following advice:

“Our advice is pretty old-fashioned:

- If you wake up at night thinking about your investment portfolio, you should reduce your risk.

- Defer discretionary spending until markets have recovered.

- Don’t listen to media pundits’ advice on market timing.

- Asset allocation matters, and investing in both stocks and bonds helps control risk.

- Market volatility creates an opportunity to rebalance to your target asset allocation.

- When valuation spreads are above normal, look to add value by stock picking.

- Investors hurt themselves by selling after declines and buying after increases. Do the opposite.

We have already experienced the duration and magnitude of the average bear market. Obviously, that’s no guarantee it won’t continue. But remember that equities have historically been the best-performing asset class despite the occasional painful bear market. We see no reason that should change.”

– Bill Nygren