Learn from the Best

In the fall of 2023, I enrolled in the MBA program at NYU Stern School of Business, where I took the Advanced Valuation course. The course is taught by Professor Aswath Damodaran, who I have followed for many years and who I believe is one of the best in the world at valuing companies. For this reason, he is often referred to as ‘the Dean of Valuation’ in media outlets such as Barron’s, Forbes and the Wall Street Journal.

The course covers all types of assets: real estate, natural resources, unlisted companies, options and, of course, listed companies. The main emphasis is on fundamental valuation based on the Discounted Cash Flow (DCF) model, but also covers relative valuation, where the value is assessed based on a comparison with other similar companies, e.g. based on P/E, EV/S or EV/EBITDA.

At the end of the course, a written analysis of a company is submitted – in my case, a valuation of the Danish listed company Coloplast. Below is the unchanged analysis for inspiration for others who are interested in seeing what a full valuation a la Damodaran might look like or are considering investing in Coloplast.

At the imminent risk of glorifying my own work, I will mention that Damodaran himself corrected and commented on the report in January 2024 and ended up with the highest rating of the course (40/40 points, 100%). Hopefully, this gives a little more weight to the analysis, but I have to say that it took a lot of hours in Excel and StatPlus to pass all the exams and write the report. It also doesn’t mean that you or anyone else necessarily agrees with the conclusions or valuation. Other assumptions will give a different result, so the general recommendation applies here as well: Always do your own analysis.

PS: The report is in English and requires some knowledge of different concepts and models.

PPS: You can access all of Damodaran’s models for free here (I used a customized version of the “fcffsimpleginzu” DCF for the report). He also has one of the most comprehensive and useful collections of base rates, which is highly recommended.

Coloplast A/S

DCF Valuation:

DKK 527.7

(43% overvalued)

Relative Valuation

DKK 555.3

(36% overvalued)

Market Price

DKK 752.6

Recommendation:

HOLD

Company overview

Coloplast (“the company”) is a Danish company with a global presence in intimate health care products. The company operates globally with 16,000 employees and has a long record of innovation in ostomy and continence care that has led to a dominant position in Europe. Coloplast has made inroads into the Urology and Wound Care markets, but remains a small player. Currently, the company is trying to raise its growth rate by entering into new geographies and through acquisitions. In 2022, Coloplast acquired Atos Medical (Voice & Respiratory segment) for DKK 10.6bn and Kerecis (Wound Care segment) in 2023 for DKK 7.9bn.

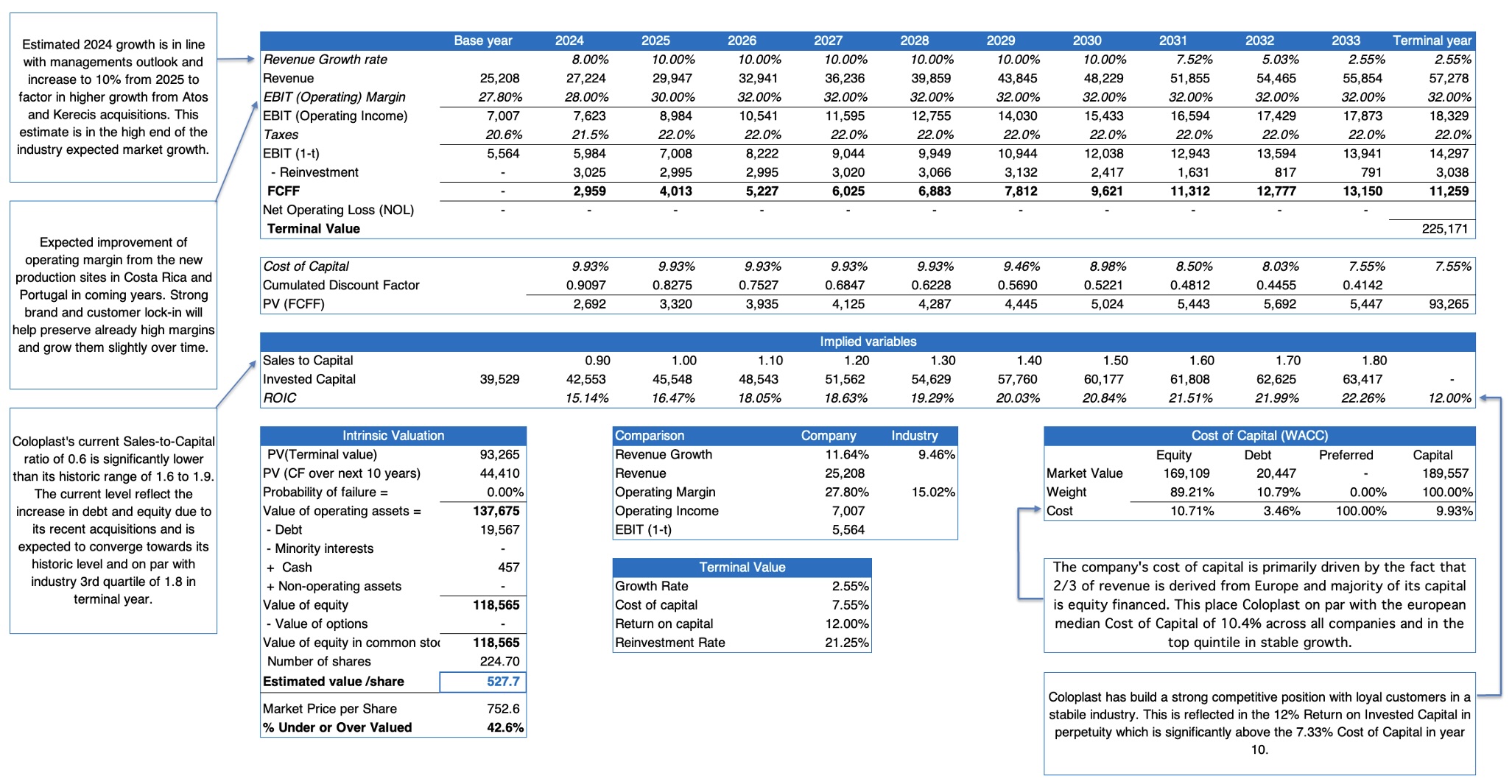

1. Discounted Cash Flow Valuation

A two-stage free cash flow to the firm model has been used to value Coloplast with an initial high growth period from 2025 (year 2) to 2030 and then gradually decrease toward its stable growth period in year 10. Below is a discussion of the key drivers of the DCF and a detailed breakdown.

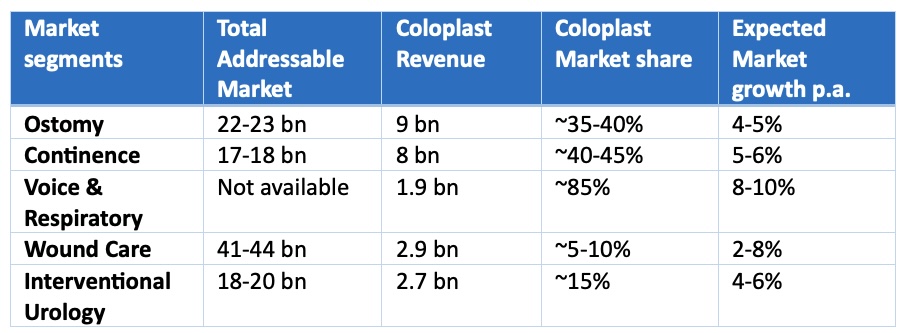

1.1 Business outlook

Coloplast operates in five chronic care segments with Ostomy (e.g. colostomy, gastrostomy) and Continence care (e.g. urine bags, catheters) accounting for roughly 2/3 of revenue. In these segments Coloplast enjoys a ~30-50% market share and an even higher market share in Voice & Respiratory segment (>80%) after the Atos Medical acquisition, but only ~5-15% in the Advanced Wound Care and Interventional Urology segments.

Wound Care represents a growth opportunity for Coloplast with a total addressable market of DKK +40bn of which Coloplast has less than 10% market share. With the acquisition of Kerecis in 2023, Coloplast are making inroads to the more advanced Wound Care market. In the Urology segment, Coloplast’s kidney stone management, inflatable penile implants and slings offer good growth potential and cross-selling opportunities.

1.2 Growth & Reinvestment

Based on these business characteristics, Coloplast has been able to maintain a 6-7% revenue CAGR and 5-6% EBIT CAGR over a +10-year period. According to industry publications and the company’s own estimates1, the growth in its current markets is expected in the range of 4-10% pa. To exceed this growth range, Coloplast would need to capture significant market share in market segments with an already large market share or move to new markets. With the company’s current 2025 strategy, few large competitors in primary segments and a relative conservative history of acquisitions and new market expansions, a growth rate above 10% is a stretch.

That said, Coloplast’s history of steady growth combined with its recent acquisitions and introduction of software to support patient’s ‘spillage’ when using its products, a positive case can be made from a growth perspective which is reflected in a 6-year high growth period of 10%. (2025-2030) after which growth is expected to converge towards the Risk-free rate in year 10 (2033). The high growth rate is supported by equity analyst’s implied 2-year forward avg. CAGR of 9.7% (Ref. S&P Capital IQ 2y forward EPS estimates) and a median global growth rate for the industry last year of 9.5%. Finally, the secular trends toward aging populations in Western Europe and US with expected increase in cases such as colorectal cancer should support a steady growth in most of Coloplast’s market segments. On this basis, the terminal growth rate in year ten in line with the Risk-free of 2.55% rate is conservative.

Following the issuing of new debt to finance the Atos Medical acquisition in 2022 and equity financing of the Kerecis acquisition in 2023, Coloplast Sales-to-Capital has dropped materially to 0.6x. Historically, the company has maintained a Sales-to-Capital ratio in the range of 1.6x to 1.9x. With an expected growth rate of 10% in coming years combined with strong FCFF and reinvestment slowing down, the company’s Sales/Capital ratio is expected to gradually return to the company’s historic level of 1.8x by year 2033.

Notes & Adjustments

Revenue adjustment

The acquisition of Kerecis was finalized in September 2023, the last month of Coloplast’s financial year. Coloplast has chosen to include 1/12 of Kerecis’ revenue and EBIT in its 2022/23 Financial statement. To keep consistency in the analysis, the full 12 months revenue of DKK 772m and EBIT of DKK 46m (corrected for acquisition related amortization) has been used in 2022/23 (base year).

R&D

Coloplast’s Research & Development has been amortized over a 7-year period reflecting the long product lifecycle and result in an adjusted increase in Operating Earnings of DKK 194m.

Operating Leases

Operating leases have already been expenses in the FY 2022/23; hence no corrections have been made.

Net Operating Loss (NOL)

The acquisition of Atos Medical has resulted in a negative deferred tax step-up of DKK 1.2bn at the end of the FY 2022/23 period. This could potentially be used as a tax carry-forward and temporarily increase FCF. However, management guidance and comments on tax for FY 2023/24 does not support this and no NOL has been included in the DCF.

Employee Stock Options (ESOP)

As of Sept. 30th, 2023, the company has a total of 2,129,562 options outstanding with a total calculated value DKK 151.6m based on Black Scholes options pricing model. The options are expensed by the company annually over the vesting period and as the company’s own ‘fair value’ estimate of DKK 156m is in line with my calculation. Hence, no adjustments have been made to the DCF.

1.3 Margins & Return on Invested Capital

After moving the majority of its production to Hungary, China and Costa Rica over a number of years, Coloplast has improved an already high gross margin from around 60% ten years ago to 65-70% in recent years. Plans for a new production site in Portugal was recently announced and is – together with others ongoing cost controls – expected to improve Operating Margin from the guided 28% next year to 32% from 2026 when the Portugal site is planned to be operational. This is in top end of the company’s historical range and above the 3rd quartile global Healthcare Products industry pre-tax operating margin of 23% in the most recent year and indicate a strong competitive position in the market.

Coloplast’s competitive advantages are primarily driven by three factors:

- Looking at its large ostomy and continence care business, the company has established a sticky end-user relationship over decades. Patients typically go through different products and configuration to find the best highly individualized solution for his or her body. Combining this with the potential risk for ‘leakage’ and the associated social risks make many patients particularly loyal once they have found a good match for their stoma. Together with a strong direct-to-consumer relation and with nurses and specialist physicians, Coloplast has been able to establish high switching costs.

- In Ostomy and Continence care, the company has built a large market share of >35%. The market segments are dominated by a few large competitors, creating a stable competitive landscape. Combined with an expected growth rate of mid-single digit, this gives Coloplast pricing power without too much risk of inviting new competition.

- The company operates with a very long time horizon in its capital allocation, which reflect both the current management team but also the special ownership structure. The founding family of Louis-Hansen continues to hold 44% of the equity and has retained 68% of the voting power through it’s A shares. On the management side, Kristian Villumsen stepped into the CEO role in 2018 with extensive experience and Anders Lonning-Skovgaard has been CFO for nearly ten years with a proven track record. Coloplast has a track record of staying within and expanding its niche markets, making selective acquisitions but also exiting business such as breast care and prostate cancer treatment when these were not accretive to the company.

These characteristics have enabled Coloplast to maintain a Return on Invested Capital (ROIC) between 40-60% over the last decade. This return has been lowered significantly to 15-17% in last two years due to the issuing of new debt and equity to finance its acquisitions. Nonetheless, based on the competitive advantages and managements excellent track record in capital allocation, I estimate that the company will continue to earn a ROIC of 12% in perpetuity, which is materially above Coloplast’s stable growth Cost of Capital of 7.6%.

1.4 Risk

Coloplast is registered in Denmark and reports in Danish Kroner (DKK) but derives most of its revenue globally. The company does not provide a currency, business or production split of its revenue/earnings but does provide a high-level regional split in revenue which has been used in calculating the Cost of Equity. The regional split in revenue shows that more than 2/3 of revenue is generated in Western Europe. To be consistent with the operations of the company and as DKK/EUR FX risk is regarded as low due to fixed exchange rate policy of the central bank of Denmark, Danish Kroner has been used as currency and a Euro zone Risk-free rate 2.55% for the analysis[1], [2].

In estimate the Cost of Equity, a ‘bottom-up’ beta has been calculated for Coloplast based on a screening of global companies within the Healthcare Equipment and Suppliers industry with a market cap of >DKK 40bn (sample = 45) resulting in an unlevered beta for the operating assets of 1,09. Using the Risk-free rate of Germany, the regional split in revenues and the calculated bottom-up beta gives us a weighted Equity Risk Premium of 6.8%. During the last couple of years. Coloplast has increased its debt position to pay for acquisition, resulting in a book value of debt of DKK 19.6bn. Based on the avg. maturity (3.7 years) and a company bond rating of BBB, this gives us a pre-tax cost of Debt of 4.4%.

Based on a calculated market value Debt-to-Equity ratio of 12.1% we get an initial Cost of Capital of 9.9%.

[1] The Euro risk-free rate has been identified by taking the lowest yield on the 10y Treasury Bonds across the 20 Euro countries. As of December 11, 2023, the lowest rate for a Euro denominated bond is the German 10-year government bond of 2.55 which has a Moody’s credit rating of aaa (highest, no default risk) and hence a default spread of 0.0%. Source here:

[2] In addition, Coloplast hedges exposure to major non-EUR currencies one year forward and debt is denominated in DKK and bonds in EUR. See FY 2022/23, note 23.

DCF Valuation - The breakdown

1.5 Discretionary & failure risk

Most of Coloplast’s current revenue and future growth is derived from Europe and North America and although it has production in China with geopolitical risks attached, this only represents one of several large production sites. From a product perspective, most of its business is derived from the ostomy and continence care segments, which are non-life-sustaining, intended for short- term use, and mostly external to the body, reducing the risks of any complications that could lead to potential defects, recalls and lawsuits. Permanently implanted devices which hold more potential for issues are only sold within the urology segment which accounts for less than 10% of the company’s revenue, and a recall would be largely immaterial. In sum, Coloplast faces relatively low risk, and no discretionary risk has been subtracted from the valuation.

With Coloplast’s recent acquisitions of Atos Medical and Kerecis, the company has materially increased its debt and equity (invested capital). Nonetheless, Coloplast still enjoys a defensive balance sheet with more than 85% equity financing when market value of debt and equity. Combining a stable revenue and operating earnings stream with a low Debt-to-Equity ratio and a proven ability to raise capital (both debt and equity), no default risk has been subtracted from the intrinsic valuation.

1.6 Value premium

Before closing the intrinsic valuation, it’s worth considering if there is some hidden option value recognized by the market, but not covered in the intrinsic valuation. In the case of Coloplast, there is at least one plausible argument for adding a premium to intrinsic value: the opportunities to expand its business beyond current product segments (Coloplast is already in all major global markets and even if new markets grow more than expected, this is largely included in the DCF growth rate of 10%).

With its recent acquisitions in the Voice and Respiratory (Atos Medical) and Advanced Wound Care business (Kerecis), Coloplast has expanded into new market segments. A second pathway into new products and services is the development and launch of software-based services such as the company’s new Heylo platform, a ‘digital leakage’ solution used by patients living with an intestinal ostomy. Although software-based solutions offer the possibility to expand, cross-sell and deepen the relationship with patients and may increase operating margin, this is already built into the existing growth case for the company. In addition, the exclusivity of these types of services are limited as Coloplast has large competitors with somewhat similar opportunities.

Looking at the majority owner and management’s historic capital allocation, they have kept a relative narrow focus on its product offerings and focused on adjacent market segments which has served the company well with high profit margins and ROIC significantly above its Cost of Capital. In sum, it’s not probable that the company will enter large new business areas, not already covered in the somewhat generous growth rate of 10% in the coming years and no value premium have been added the DCF.

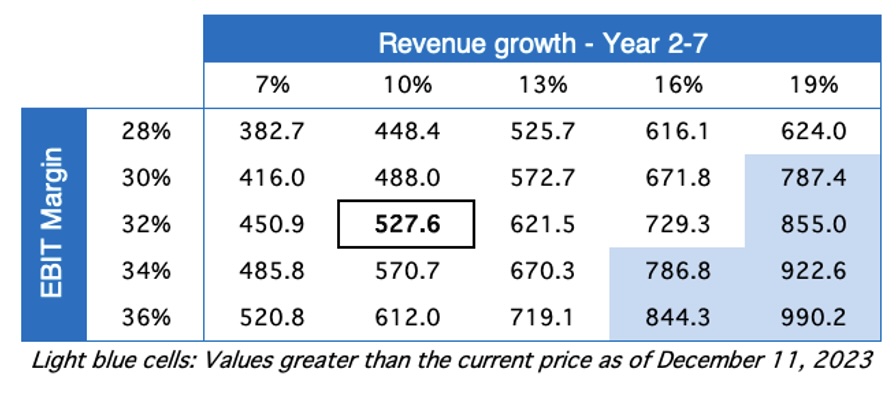

1.7 Sensitivity analysis & DCF conclusion

The DCF analysis results in an intrinsic value of DKK 527.6 per share. This is ~43% lower than the current market price of DKK 752.6 as of December 11, 2023, and implies that Coloplast is currently overvalued. To further investigate what drives the valuation, a sensitivity analysis has been performed. The results show that making reasonable changes to re-investment rate and risk (WACC) have limited impact on the valuation. Hence, the sensitivity table below is therefore focused on revenues growth and operating margin.

As can be seen, Coloplast’s shares are overvalued in most combinations of revenue growth and EBIT margin. In fact, it’s only when using a 16% growth rate or higher that the current stock price is justified. Taking equity analyst’s implied 2-year forward avg. CAGR of 9,7% into consideration together with a median global growth rate for the industry last year of 9,5%, this is in my view an improbable scenario and results in a HOLD recommendation.

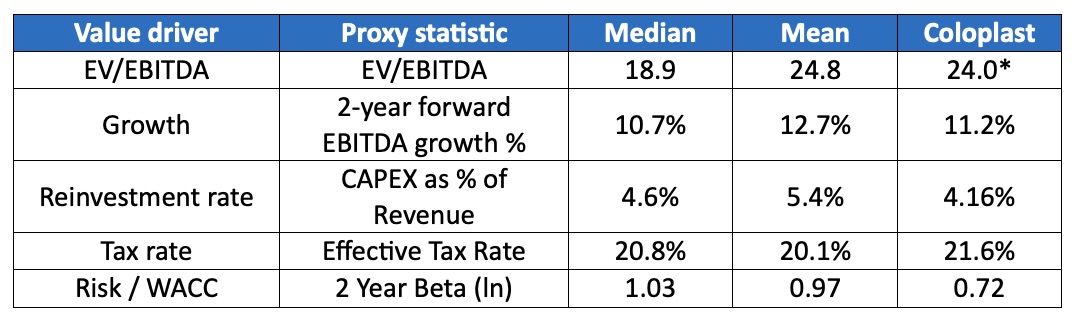

2. Relative valuation

2.1 Multiple & Variables

Coloplast is a mature company in a growing but mature industry with positive earnings which enables us to use EV/EBITDA. EV/EBITDA is used as industry peers have different level of financial leverage and since they treat items such as R&D differently. In other words, EV/EBITDA allows for direct comparison between the peers and is less affected by accounting practices.

Data is collected from S&P Capital IQ using the screening criteria listed in the infobox below. A wide screen including developed regions was used as Coloplast is a global company both in terms of competition, production and market exposure.

The value drivers of the EV/EBITDA multiple are cost of capital, expected growth rate, tax rate and reinvestment rate. As this is a pricing analysis, different proxies were tested, and descriptive statistics used before settling on the ones listed below. In case data was unavailable, comparables were dropped, leaving the final list om companies (sample) at 39.

As can be seen above, Coloplast offers a higher growth rate at a lower reinvestment rate than the median company in the industry. And although the company has a slightly higher effective tax rate it enjoys a lower 2-year beta which is a positive for risk averse investors. Based on these characteristics, I would expect Coloplast to trade at an EV/EBITDA multiple above the industry median which is clearly also the case.

Notes & Adjustments

Multiple selection

Different EV multiples have been tested before settling on EV/EBITDA as the one with the highest R-squared.

Screening criteria (CapIQ)

- Company type = Public Company

- Regions: Europe, USA & Canada, Asia Pacific Developed Markets

- Industry Classification = Health Care Equipment and Supplies

- Market Cap [latest] = >DKK 40 bn

*EBITDA adjustment

To keep consistency in the analysis, EBITDA has been adjusted to reflect 100% of Kerecis EBITDA (compared to the 1/12 Coloplast has included in the annual report).

Variables tested but rejected due to low correlation:

- Total debt to Capital

- 3-Year historical EBITDA CAGR

- Return on Capital

- 1 Year Beta

Beta / Natural log

Beta is adjusted for positive skewness, so the natural log (ln) of beta is used.

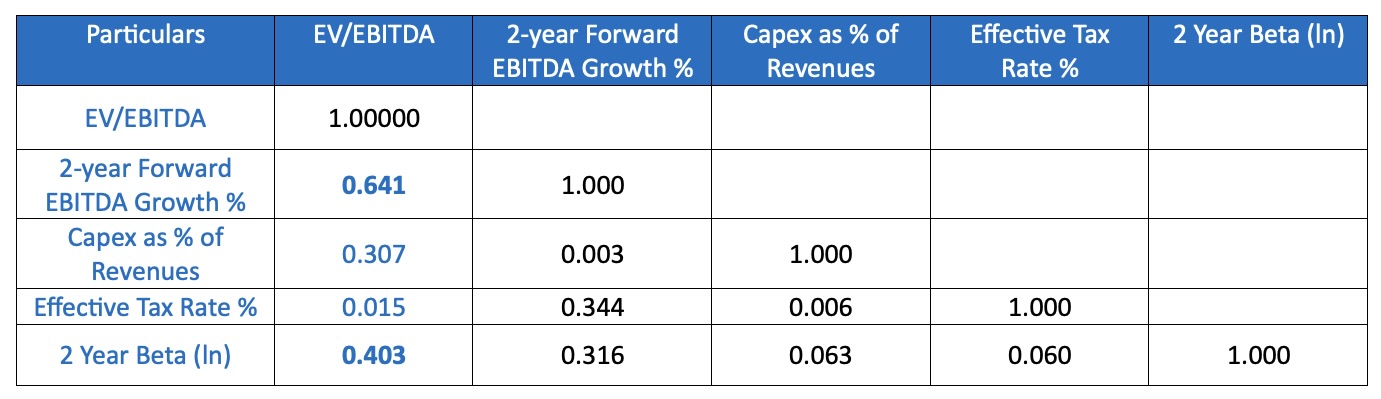

2.2 Correlation Matrix

A correlation matrix was created to find proxies with the highest correlation to the dependent variable whilst attempting to mitigate the risk of multi-collinearity between independent variables.

The correlation matrix show that effective tax rate has a low correlation to EV/EBITDA in addition to a low t-statistic. In addition, more than three independent variables on a sample of 39 will bring its own statistical challenges. For these reasons, effective tax rate is dropped from the analysis.

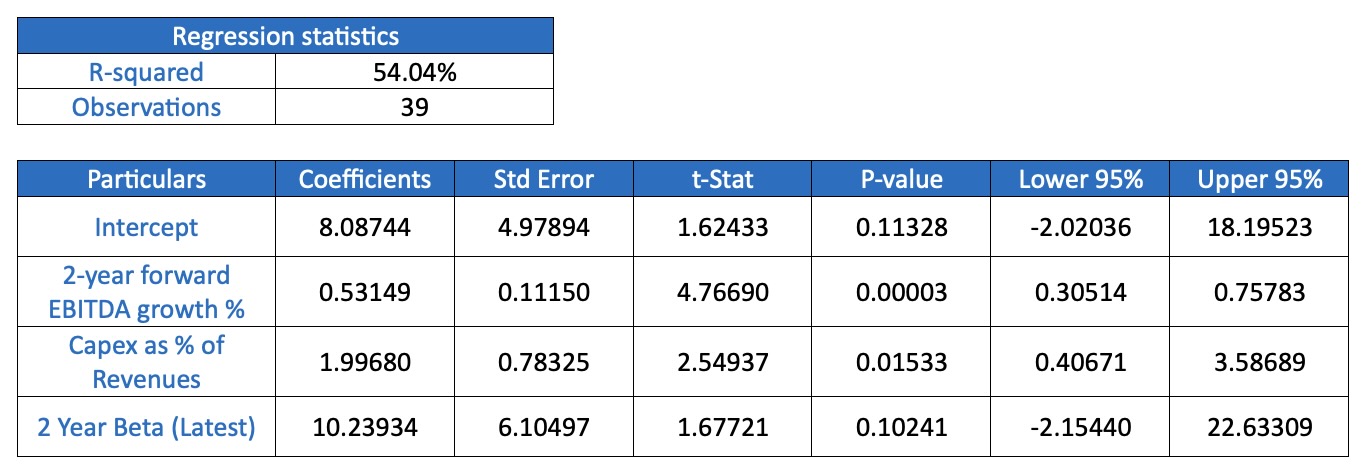

2.3 Regression

Running the regression results in anR2 of 54.04%. As can be seen below, EBITDA growth and CAPEX as % of Revenue both have low standard error and high t-statistics which provide robustness. However, 2-year beta has a high standard error and a t-stat of 1.68 which is acceptable but question the significance of the variable. In the end, I decided to keep Beta in the regression as a proxy for risk.

2.4 Regression equation

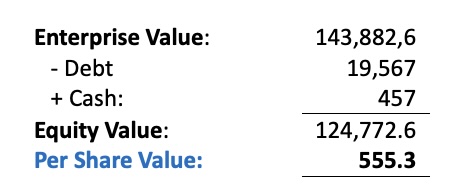

Substituting with Coloplast’s variables result in an EV/EBITDA ratio of 18.9 which correspond to an overvaluation of 26.9% compared with its current multiple of 24.0. Recalculating EV and Equity value based on the regression show the following results (mDKK except share price):

Correcting for debt and cash results in an equity value of DKK 124,772.6m, equal to a share price of DKK 555.3, which 35.5% above the current stock price. From a relative valuation perspective, Coloplast is given a HOLD recommendation.

3. recommendation

Coloplast is in many ways a high-quality business with operating margins significantly above the industry median and has a management team that must be applauded for its investment returns over the years. Combined with a stable and growing industry covering patient chronic care products there is much to like. However, this is clearly also the market’s conclusion with a price more than 40% above over the fundamental DCF valuation as well as 36% above industry peers based on a relative price valuation.

Overall, this points to more downside than upside from the current price level. If the stock price drops below DKK 550, Coloplast is likely to be a good long-term investment. Although this does not leave room for a ‘mathematical’ margin of safety, the quality of the business combined with a long time horizon will in my opinion serve as sufficient margin. Based on the analysis and the current stock price, Coloplast is a recommended HOLD.

Full Transparency

At the time of publication, the author or his/her close relatives have no positions in companies mentioned in the article.

The author or his/her related parties have not received any payment from companies mentioned in this article, nor do they have an employment relationship with the companies mentioned.