What are the world's best investors doing right now?

You don’t have to find new, unique investments to generate a good return. On the contrary, there is a veritable goldmine of knowledge and investment ideas hidden in studying the best investors in the world. This is because there are legal requirements in both Europe and the US for professional portfolio managers to publish their portfolios. In the US, it must be done quarterly for all portfolios over 100 mUSD (13F filings).

Find managers whose investment philosophy matches your own. Or start with the list here on Børsgade – they’ve all shown sublime returns over decades and have a long-term and fundamental investment philosophy. Study their portfolios and track which companies they buy and sell each quarter.

You can find the current portfolios of the legendary investors here.

What can we learn from studying portfolios?

We can use the current portfolios and buy/sell trends for multiple purposes:

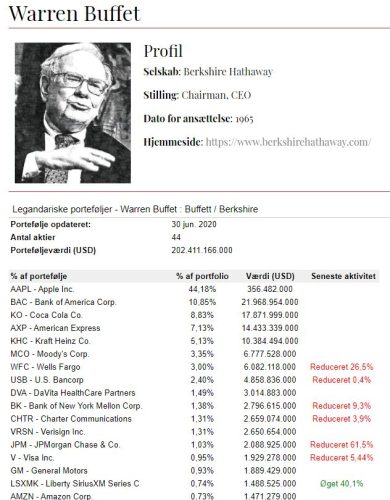

- Source to identify interesting companies that we should take a closer look at and potentially become co-owners of. I maintain watchlists with the individual portfolios myself, so I have an overview of the companies’ key figures and can dive deeper into the analysis. Are there new companies in the portfolio or are they buying companies that they know intimately and that I should therefore take a closer look at? What does it say about the industry – for example, are there smaller companies with similar characteristics in the same industry that might be a better buy but are too small for their multi-billion dollar portfolio?

- By tracking portfolios over time, we can see how investors view the temperature of the market. Are they net buyers or sellers of companies and is there a trend over several quarters? How does this harmonize with their statements in the media, shareholder letters, quarterly reports, etc. Given this, should we be defensive or offensive ourselves?

- Learn from the world’s best investors by analyzing the companies they have bought and sold over the years. What are the key figures of the companies they choose to buy, what is a good company for Seth Klarman or Warren Buffet? Which companies do they consider to have a sustainable competitive advantage (‘moat’) and excellent management? Why did they buy at that particular time?

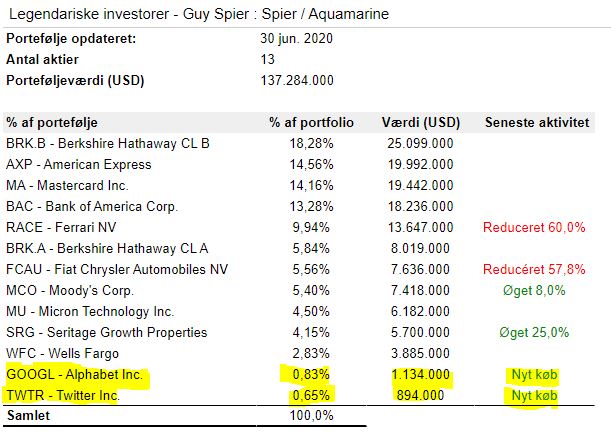

Example: Guy Spier buys Twitter and Google

In Q2 2020, Guy Spier added two new companies to his portfolio: Twitter and Google. It’s a concentrated portfolio with only 13 companies and it’s not often that Spier acquires new companies. At the same time, these are two companies that are not exactly traditional ‘value’ companies. Both have high multiples, e.g. P/E and P/B.

Why is Spier getting into them now? Of course, there can be a number of reasons for this, and the companies have undoubtedly been closely monitored for many years before entering the portfolio. Basically, these are companies that are likely to grow their earnings over many years. At the same time, Google has not seen the same price increase as other major tech companies in the first half of 2020. Twitter is starting to see profits from its operations.

In any case, these are companies that would be quite interesting to dive into.

Remember...

No matter where or from whom you get your investment idea, you should always do your own analysis and complete your checklist. Why would it be necessary, you might ask? Two simple reasons:

- Even super-investors can make mistakes, perhaps their choices don’t fit into the composition of your portfolio or don’t align with your values. You owe it to yourself to know the rationale behind the investment in question. It will also act as a mental shield, especially if the stock drops significantly in value after you’ve bought it. At the end of the day, it’s your decision and your savings.

- If you don’t self-assess and document your investment decisions, you have no opportunity to learn from your mistakes. And that’s the only way to become a better investor.

Find more information about the rationale behind

If you want to learn more about the rationale behind individual purchases and sales, many investors publish a ‘letter to shareholders’. Either quarterly or as part of their annual report.

See for example Warren Buffet’s annual letter to shareholders in Berkshire Hathaway’s annual reports and Thomas Gayner’s shareholder letter on Markel’s website.