2021: An exceptionally good investment year

Another investment year is coming to an end. And what a year it has been for us investors. While the average return on the stock market over the past 50 years has been around 7%, this year we have seen increases of no less than 15% in Denmark (OMX C25), 20% in Europe (EuroStoxx 50, EU50) and almost 30% in the US (S&P 500, SPX).

But what was the starting point when we entered 2021? With such high returns this year and a pandemic in 2020, surely the starting point was a low point? Uh, no. Actually, no. Although we saw a downturn in most markets of 30% in February and March 2020, over the full year the return in Denmark was over 35% (!) and the US 17%. The exception was Europe, which saw a decrease of ~3%. In other words, it has been very lucrative to be an investor in recent years. There are many good (and not so good) reasons for this – historically low interest rates, national banks printing money, governments giving very large financial packages to economies, etc.

The exception: Emerging Markets & China

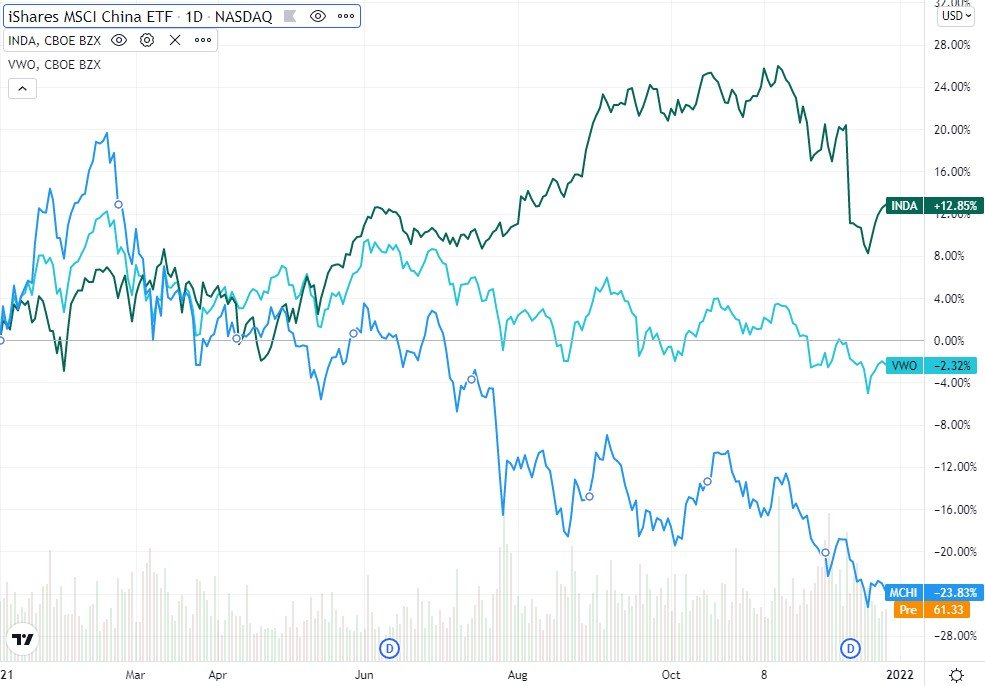

However, the great returns have not been present in all markets. Looking at Emerging Markets (a collective term for developing countries such as China, India, Russia, Brazil and others), these markets have delivered a total return of just around 1% in 2021 – illustrated below with the world’s largest emerging markets index fund, Vanguard’s ‘VWO’.

Going a step deeper, the differences are also large within the group of developing countries. India is one of the positive examples with a return of over 12%. However, the most eye-catching is China, where a combination of the Chinese government’s political intervention, strict Covid-19 lockdowns, and trade war with the US has led to a drop of almost 24% in 2021. This results in a difference between the Chinese and US markets of over 50%. It’s thought-provoking and shows how big the differences can be from year to year.

If you can accept the political risk associated with investing in China, it’s also a hint that the Chinese market contains more companies with a low price tag versus the US. This is not reason enough on its own, but should prompt further analysis of companies in the Chinese stock market.

Alignment of expectations

The good question now is: Can it last? As so often before, Buffett has reflected on similar situations. In his ‘Annual letter to shareholders’ in 1999, Buffett reflects on the high prices and investors’ very optimistic expectations for the future:

“We have never attempted to forecast what the stock market is going to do in the next month or the next year, and we are not trying to do that now. But [as of late 1999] equity investors currently seem wildly optimistic in their expectations about future returns.”

Valid arguments can be made that the situation is different than in 1999, but after a decade of very high returns – some years of 20-30%, the quote seems very apt. Buffett continues his letter by explaining that the rise in stock prices is fundamentally based on companies’ earnings growth. And the overall growth in corporate earnings is equal to the increase in a country’s gross domestic product. In other words, as investors, we can expect a real return of around 3% (the typical increase in GDP in countries like Denmark and the US) plus around 2% inflation per year, giving us an expected return of 5-6%.

All this is not to spoil the good vibes, but just a reminder that trees (as we all know) don’t grow into the sky. We have had rising markets for many years and 2020 and 2021 have been atypically good years. It is very possible that 2022 will also be a similarly good year, but we should remember that the most likely scenario is a return in the range of 5-8% in 2022. Maybe higher, maybe lower.

Inspiration for 2022

Here at Børsgade, we spend a lot of time following and learning from the many talented investors (‘gurus’) who share their knowledge on a variety of media. Their own company websites, YouTube, newspaper articles, CNBC, Bloomberg, podcasts, etc. etc. To make it easier to follow the many investors and media outlets, we have built a small engine to collect and filter the many news stories.

This news feed serves multiple purposes:

- Get ongoing inspiration on which markets and specific companies the gurus are focusing on. What do they consider ‘expensive’, where do they see interesting acquisition opportunities and why? Not everything ends up in their own portfolios (e.g. because they are tied to a specific geography or allocation) and even if they do end up with a trade, we can only see it in their official portfolios after several months.

- Get nuance and context on the companies the gurus have bought or sold in a given period. Many of the investors we follow write a letter to their investors, e.g. every six months, explaining their thoughts and rationale. Not only that, several of them are so gracious that they make them freely available on their website for all of us to read, such as Tweedy Brown and Warren Buffett.

- Get a better understanding of how the gurus see the current market situation (macro picture) in different geographies. One example is Howard Mark’s sublime ‘Memos’. But another interesting example has been Ray Dalio’s comments about China in the second half of 2021.

- Become a better investor. One of Warren Buffett’s fundamental principles is that you should always surround yourself with people who are better and more capable than you. The same approach to life was taken by physicist and Nobel Prize winner Richard Feynman, who was never afraid to take on new disciplines (think Brazilian bongo drum). If you find yourself in a room where you’re the person who knows the most about the topic under discussion, there’s little chance you’ll learn anything. Unlike if you’re one of the least knowledgeable. And how do we private investors do this in practice? Yes, we read and listen to what the best investors in the world have to say on a given topic. We may not necessarily agree, but there’s a good chance we’ll learn something.

Let’s get this out of the way right away: The engine for Guru Articles & Comments is still a work in progress, so it will (hopefully) get better over time. But it will already help you gain ongoing inspiration and perspective from many of the most respected investors in the world.

You can read the latest articles and comments here