From deficit to profit

ATP had a very difficult 2022 with a loss of no less than DKK 57 billion. This has now turned into a small plus of just under DKK 3 billion in total and an investment return of just over DKK 1 billion. Below we dive into the half-year report and look at the changes made from the end of 2022 to six months later.

I am satisfied that we have put a difficult 2022 behind us. The return in the first half of the year is positive, and the investment strategy provides ATP’s members with a guarantee that they will receive what we have promised them when they retire.

Martin Præstegaard, CEO of ATP

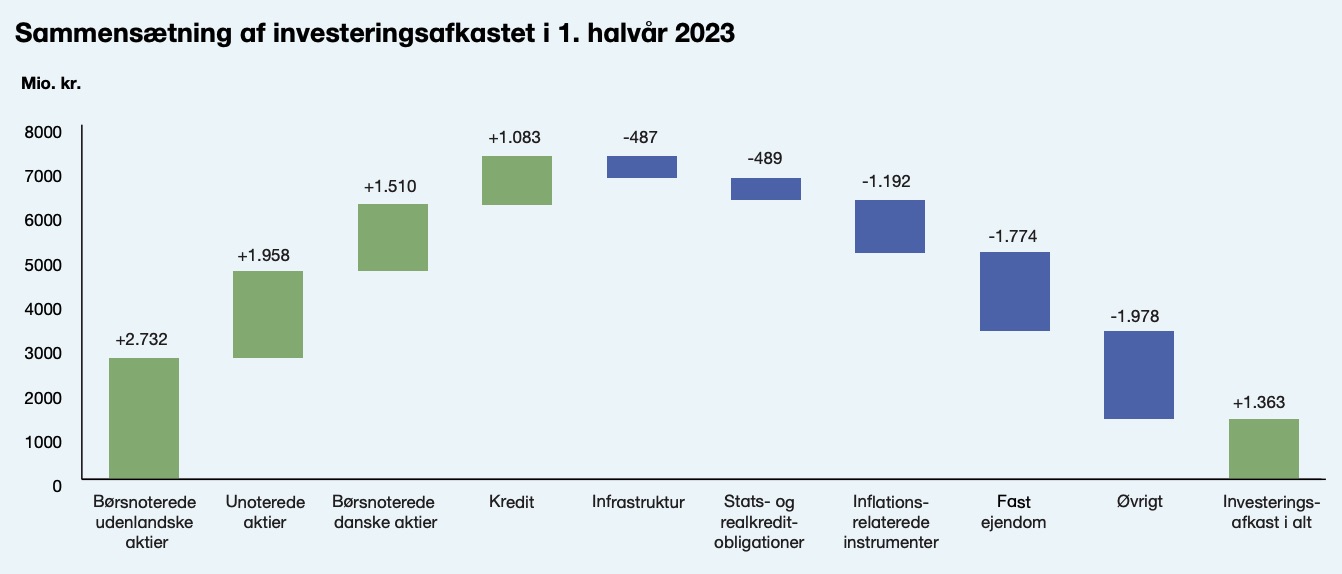

If we look at the investment return, it is primarily driven by listed foreign and Danish equities and ownership in unlisted equities, which actually matches the return of the global equity market.

On the negative side (in blue below), the largest item is real estate investments. As a result of the higher interest rates, ATP has to accept that their properties are depreciating in value because the required rate of return on real estate is higher today than it was six months ago. However, it is worth noting that this is an accounting change and will be turned into a positive return if interest rates fall again.

How ATP invests in the different asset classes

If we look at ATP’s balance sheet – i.e. how the total assets are allocated between the different asset classes – we see that the largest exposure is in Bonds with no less than 55% (DKK 474 bn. versus DKK 483 bn. at the end of 2022). This is not surprising, as ATP is required by the ATP Act to have the majority of its portfolio in ‘safe’ investments such as government and mortgage bonds. With rising interest rates in 2022, it was bonds that were the primary reason for the somewhat horrible 2022 returns.

Source: ATP half-year report 2023. Preparation: Børsgade

| wdt_ID | Aktiver | H1 2023 | H2 2022 |

|---|---|---|---|

| 1 | Obligationer | 473,504.00 | 483,354.00 |

| 2 | Unoterede kapitalandele | 110,464.00 | 114,430.00 |

| 3 | Afledte finansielle instrumenter | 77,152.00 | 82,270.00 |

| 4 | Noterede aktier | 51,926.00 | 50,855.00 |

| 5 | Udskudt pensionsafkast- og selskabsskat | 47,279.00 | 48,534.00 |

| 6 | Tilgodehavender vedrørende reverseforretninger | 30,264.00 | 25,669.00 |

| 7 | Investeringsejendomme | 24,067.00 | 24,858.00 |

| 8 | Øvrige | 35,502.00 | 38,647.00 |

Source: ATP half-year report 2023. Preparation: Børsgade

The second largest allocation is in ‘Unlisted equity investments’ with an allocation of DKK 110bn, which consists of unlisted companies in which ATP has an ownership interest. The asset class contains a wide range of companies in everything from seed funds to energy companies to affiliated companies in which ATP owns 100%, e.g. ATP Real Estate and ATP Private Equity Partners.

Next up are “derivative financial instruments”, which basically cover various forms of interest rate and currency swaps, forward contracts and options.

Listed shares – i.e. Listed companies – are in fourth place with DKK 52 billion, up from DKK 51 billion at the end of 2022. In the half-year report, ATP writes that they have had a total return of DKK 4.2bn for listed Danish and foreign investments. In practice, this means that they have lowered their total allocation to equities by just over DKK 3 billion.

At the same time, we can see that despite a loss in investment properties of DKK -1.8 billion, they have only lowered the allocation by approx. 800 million and thus increased this position by just over DKK 1 billion.

These adjustments paint a picture that ATP still sees risk in the equity market and is thus taking a defensive position at the beginning of the second half of 2023. Thus, the changes in the portfolio match their attitude to the market quite well:

For the remainder of the year, the financial markets are expected to continue to be characterized by high uncertainty. ATP maintains the disciplined approach to risk management in order to generate the best possible returns […]

ATP’s press release (August 29, 2023)