Two interesting investment cases

In continuation of my article on the current Chinese market, below you can read an analysis of two specific Chinese companies that I believe are very interesting investment cases at current price levels (August 2021). Both companies are among the largest in the world in their respective markets and have a fundamental value that is significantly higher than the current market price.

The analysis is just two concrete investment ideas among many and, as always, cannot replace your own analysis and assessment. If you do not have the opportunity to dive in and analyze the two companies yourself, but want to invest in China, I would recommend buying a Chinese index such as iShares MCHI or iShares MSCI China UCITS ETF (ISIN: IE00BJ5JPG56), which can be traded from Nordnet, among others.

Alibaba: Munger, Pabrai, Tweedy Brown buy up

Alibaba is one of the Chinese companies that has long been an interesting investment case. The company is the world’s largest online and mobile commerce platform by revenue of goods sold (more than USD 1 trillion in fiscal year 2020). The company has China’s most visited online marketplaces, Taobao, which is consumer-to-consumer sales (similar to Den Blå avis in Denmark and e-Bay in the US) and Tmall, which is business-to-consumer. Marketplaces account for around 70% of Alibaba’s revenue with the remainder split between cloud computing (AliCloud) and entertainment platforms and logistics (Cainiao).

Alibaba popped up on my radar at the beginning of the year because several of the investors we follow here at Børsgade took significant positions in the company in Q1 2021, including Charlie Munger (via Daily Journal), Tweedy Browne Co, Mohnish Pabrai and Thomas Russo. We now have data for Q2 2021, where we can see that several of these investors have continued their acquisitions. Pabrai has increased his position by 50% to over 20% of his total US portfolio, Tweedy Brown and Thomas Russo have both increased their positions by over 30% to just under 3% of their portfolios. Furthermore, in Q2, Guy Spier also took a significant position in the company, which now accounts for over 5% of his total portfolio. It’s rare that so many of the investors we follow on this site buy the same company within the same short period of time.

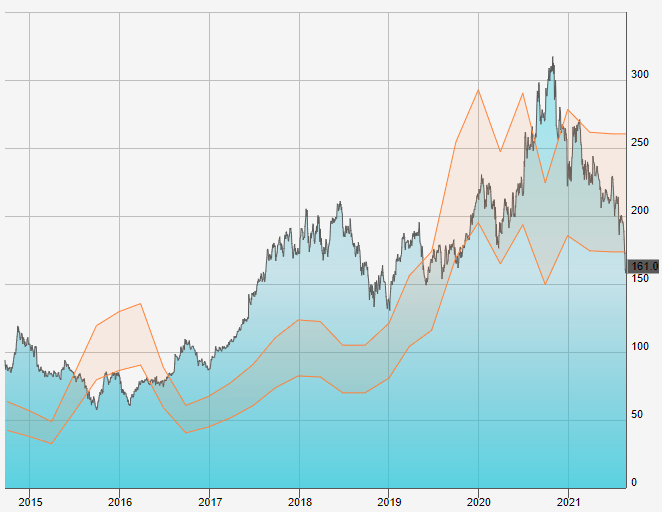

Another interesting development is that the price of Alibaba (as with virtually all other Chinese companies) has fallen steadily over the year and is now cheaper than in both Q1 and Q2 2021. In Q1, the share price has averaged around USD 240 and in Q2 around USD 215. By mid-August 2021, the stock is trading around 160 USD. So here’s a The opportunity to buy into a company that a number of the world’s best investors have rated as a good investment and at a price significantly below their average price. It should be added that these investors are thorough and very experienced value investors who do not buy a company unless they believe, after a thorough analysis, that the company has a fundamental value that is significantly higher than the price at which the share is trading.

A final reason why the investments in Alibaba stand out is that several of the investors mentioned rarely take new positions, especially on this scale. For both Charlie Munger and Guy Spier, it often takes several years between buying a new company. The question remains – why Alibaba and why now?

BABA Chart

by TradingView

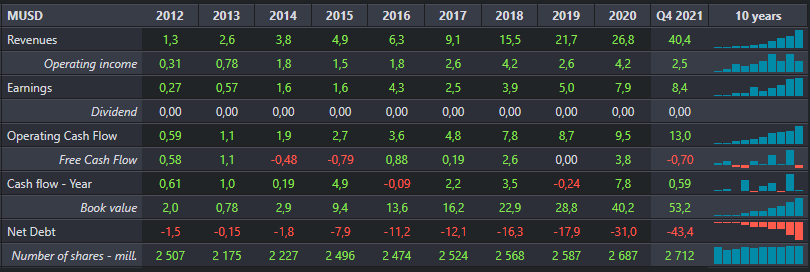

A growth stock with historically low ratios

If we take a deeper dive, Alibaba’s development over the past 10 years speaks for itself. To ensure that we are comparing real numbers year-on-year, we use the ‘per share’ metric (EPS adjusted for share issues/repurchases). Revenue per share has increased 40-50% annually. Earnings have fluctuated more, but the average is at the same level. In practice, this means that Alibaba’s revenue and earnings per share will be more than 30 times higher in 2021 than they were ten years ago. The company’s book value follows the same trend (P/B). At the same time, Alibaba’s debt is ‘negative’ – which in practice means they have more net assets than liabilities. If another company wanted to buy all of Alibaba in the open market, they would not have to take on any debt, but only pay the market price (outstanding shares multiplied by the share price) plus any additional premium for the extra assets Alibaba owns (e.g. shares in other companies) and control of the company.

Key figures in perspective

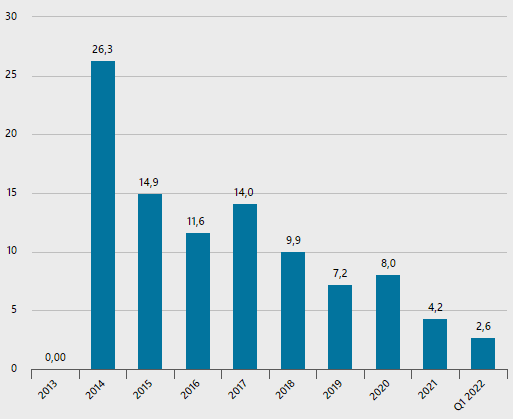

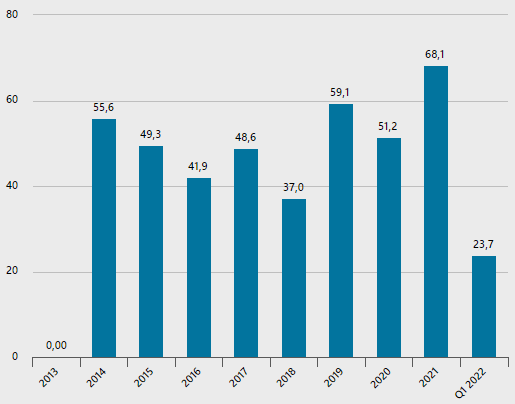

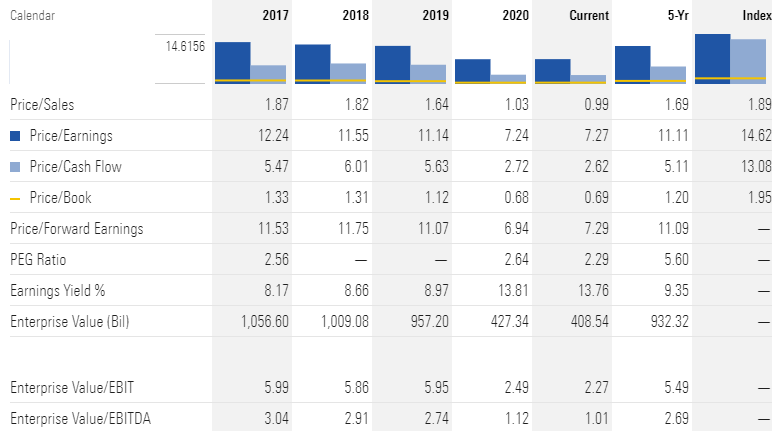

If we look at Alibaba’s ratios in relation to the multiples at which the company has historically traded, they are lower than they have been at any point in the last 10 years. The graph below left shows Enterprise Value to Sales (EV/S), which is a good indicator of a growing company that can have quite large fluctuations in earnings due to investments. EV/S has steadily decreased over the years and is now a third of the five-year average.

If we look at Enterprise Value to EBIT (EV/EBIT), which relates to the company’s earnings, we see the same trend. Alibaba is trading at between half and a third of historical ratios.

If we look at the competition, the most obvious international comparison candidate is Amazon.com. Amazon trades at EV/S of 3.7 (vs. 2.6 for Alibaba) and with an EV/EBIT of 54.9 (vs. 23.7 for Alibaba). In other words, Alibaba trades at about half the ratios of Amazon.

A back of the envelope valuation

Now, as we all know, trees don’t grow into the sky, so let’s see what a simple DCF calculation gives us if we set some more conservative growth rates going forward. We can choose many scenarios here, but let’s be realistic and assume an average EPS growth of 15% for the first ten years and 3% growth thereafter (in line with long-term inflation). If we discount this at a rate of 10% to account for the relatively high risk of Chinese tech companies, but take into account that Alibaba has no debt, we end up with a valuation in the range of USD 215 – 325 per share.

In addition, out of respect for the uncertainty in all valuations, we will require a margin of safety of at least 20%, as we learned from Ben Graham. This gives us a valuation in the range of USD 175 to 260 per share. With a current share price around USD 160, my assessment is that we have a wide margin of safety.

China Mobile - The world's largest telecom company is one of the cheapest

China Mobile is another interesting Chinese company that – unlike Alibaba – is rarely mentioned in Western media. However, the company made headlines along with the other Chinese telecom companies when the US government decided to force a delisting in the US due to possible links to the Chinese military. As a result, many US shareholders were forced to sell their holdings, while others were forced to switch to the Chinese listings in Hong Kong, ultimately leading to a drop in the share price. The validity of the allegations is very difficult to assess as an investor and must be seen in the context of the ongoing trade war between the US and China.

With 940 million customers, China Mobile is not only China’s largest telecommunications company, but also the world’s largest. With its extensive customer base, the company can keep much of the traffic exclusively on its own network, keeping costs down. This has given China Mobile an operating margin of 15-17% over the past five years and a cash balance (including investments in other listed companies) of no less than €58 billion. USD by the end of 2020, which is the highest among the major telecom companies internationally.

The Chinese government is the majority shareholder in all three major Chinese telecom companies and has a stake of over 70% in China Mobile. To control the market, the government has for many years forced the company to use the Chinese-developed “TD-SCDMA” technology for 3G mobile broadband, which has reduced China Mobile’s market share from 71% in 2012 to 61% in 2020. This is set to change with the transition to 4G and especially 5G, where China Mobile can offer similar technology to its competitors. China Mobile has also been aggressive in taking market share in fixed broadband.

The company has just published its half-year results, which surprised on the positive side: revenue increased by almost 10% and 6% on the bottom line. In fact, earnings would have increased by over 16% if it wasn’t for increased depreciation and amortization of approximately €1.2 billion. USD during the period. Growth is particularly driven by the rollout of broadband (33%), data centers (27%) and cloud (118%).

Development over 15 years: Roller coaster ride and down in the last 6 years

If we look at the price development of China Mobile over the past 10+ years, the most appropriate term is probably desert wandering. The exchange rate skyrocketed in 2007 from around 70 HKD (Hong Kong Dollar) to 150 and back to 70 in the same year. After that, the price has fluctuated between 70-90 HKD for the past 10 years, but started to fall in 2016 and is now down to around 50 in July 2021.

Historically low key figures

Looking at the multiples that China Mobile usually trades at, the current price (approx. 50 HKD) is around 30-50% below the last 5 and 10 year averages: P/S is 1.0 versus 1.7 over the last 5 years, P/E is 7.3 versus 11.1, P/B is 0.7 versus 1.2, EV/EBIT 2.2 versus 5.5. In addition, it should be taken into account that over the past several years, the company has built up a massive cash balance of no less than EUR 58 billion. USD by the end of 2020 (CNY/USD exchange rate 7.77) and has no significant debt. If this is included in the key figures, the company’s real P/E will be below 5.

This basically means three things: One: management has not been good at reinvesting the company’s free cash flow, two: the company’s dividend of around 6.8% (yes, you read that right) is quite safe going forward and can be increased, and three: There is the possibility that the company can pay a special one-off dividend, buy back its own shares or invest/buy in the market. The primary concern is management’s lack of action over many years.

Price relative to other telecom companies

If we look at China Mobile’s ratios relative to the Chinese market in general (Morningstar China GR CNY), both P/S, P/E and P/B are more than 40% below the general level. This is despite the fact that the Chinese stock market is quite low compared to, for example, the US market, where the P/E is around 25 versus China at 15.

If we compare the ratios with other of the world’s largest telecom companies such as Verizon Communications in the US(which Warren Buffett recently bought), Nippon Telegraph and Telecom in Japan, BT in the UK and Deutsche Telecom in Germany, their P/B ranges between 1.4 and 3.1. The average for the major international telecom companies is around 2 P/B versus China mobile at 0.7 of book value.

If we look at the same companies’ earnings, here represented by EV/EBIT, they range between 8.8 (Nippon) and 15.1 (Verizon) versus China Mobile at around 3.2 (lower is cheaper).

Valuation

If we try to compare the price with the key figures that China Mobile has historically traded for and that competitors internationally trade for, we need to add 40-50% on top of the current market price. If we just take the average, this gives us an estimate of around 70-75 HKD/share (50HKD*1.45).

Now let’s try to do a simple DCF and see where we end up. Looking at the company’s long-term growth in earnings (EPS), it is expected to be fairly limited due to the competitive environment and government interference – probably around 3% annually. Taking a reasonably conservative discount rate in line with the company’s WACC of 10% (due to high risk but no debt) gives us a valuation in the range of HKD 80-90/share. If we subtract a 20% margin of safety, this gives a valuation in the range of 65-75 HKD. With a current share price below 50 HDK, China Mobile is selling significantly below fair value.

Risks of investing in Chinese tech companies

Much can be written about each of the two companies in relation to specific risks. Fundamentally, however, I would say that the overriding risk for both companies – and in my view the primary reason for the low share prices – is the uncertainty surrounding the Chinese government’s interference going forward. For both companies, the question is how much government intervention will lead to a decline in the companies’ earnings over time. On the one hand, there is no doubt that uncertainty is greater than governments in the US or Europe, for example. But the question is how much this uncertainty should weigh down, as there are also major anti-monopoly cases against the big tea companies in the US and Europe. From my perspective, prices are now at a level where we as investors are more than fairly compensated for this increased uncertainty in China.

Looking at the two companies individually, a few additional risks are worth highlighting. For Alibaba, the government has recently fined the company €2.8 billion. In April 2021, Alibaba was fined USD 1.5 billion for abusing its dominant position and preventing the listing of Ant Financial, Alibaba’s financial services business. Ifht. competitors, Pinduoduo is now growing faster in terms of new users and Gross Merchandise Value (GMV) and JD.com is similarly a worthy competitor with high growth. Ifht. The primary ESG concern is the management decision by Jack Ma to transfer ownership of Alipay to a new company, Ant Financial, which is only 33% owned by Alibaba, without the approval of Alibaba’s two major shareholders, Yahoo and SoftBank.

For China Mobile, the issue of Chinese government interference is particularly relevant and differs in that the Chinese government owns 74% of the company. Therefore, it cannot be expected that the interests of individual investors will always be prioritized. The Chinese government also owns over 70% of the other two major Chinese telecom companies, China Unicom and China Telecom, which has meant that at one point they switched CEOs between the three companies (yes, you read that right). Similarly, the government can make decisions that could negatively affect the company’s operations, such as not laying off staff to keep unemployment in the country low or restricting access to future networks such as 6G.

Another real concern is the government’s different targets for price cuts and demands to remove roaming charges, which today help secure the companies’ margins. However, this has some similarities to the development in the EU and the lowering of mobile data prices we have seen in Denmark and the EU. Despite these challenges, China Mobile has been able to maintain healthy margins and high free cash flow over the past decade. Coupled with the government’s need to expand and improve telecom infrastructure, there is much to suggest that China Mobile will remain a healthy business.

Internship on purchase

A final note should be made in relation to the practice of trading Chinese companies. Due to the trade war between China and the US, as described above, you can no longer trade China Mobile in the US (formerly China Mobile ADR). However, Alibaba ADR can still be traded in the US and purchased via e.g. Nordnet.

However, my recommendation would be to buy both companies (or other Chinese companies) via one of the Chinese listings. Should the situation between the US and China escalate, it will not directly affect Chinese listings. In my case, I have chosen the Hong Kong Stock Exchange, which can be traded at a reasonable price at SaxoBank, for example, but probably also at other banks/trading platforms. I know – it’s a bit of a hassle if you haven’t done it before. But if the investment was easy and there were no risks to worry about, we wouldn’t be able to expect a high return (!).

Full transparency:

The author of the article does not work directly or indirectly for the companies mentioned.

At the time of publishing this post, the author or a related party has invested in Alibaba and China Mobile.