As previously described on this site, you don’t need to find new unique investments to generate a good return. On the contrary, there is a veritable goldmine of knowledge and investment ideas hidden in studying the best investors in the world. Below you will find a selection of the most interesting purchases and sales in Q4 2020, which were published in the period February 10-17, 2021.

You can find all the updated portfolios here.

Seth Klarman buys into Intel

For more than three decades, American chip manufacturer Intel has delivered annual growth rates of over 20% – both in terms of revenue and earnings. It’s simply spectacular. But over the past few years, Intel has faced challenges with their production process and the transition to the new 10-nanometer technology. At the same time, competitors from Samsung and Taiwan Semiconductor have switched to 7-nanometer and are working on 5-nanometer and have therefore been able to take market share from Intel. This has left its mark on Intel’s share price, which has hovered around the USD 50 mark for the past three years.

It was therefore quite interesting when I saw that Seth Klarman has taken a large position in Q4 2020. So big, in fact, that Intel is now the third largest company in the portfolio with 8.4%. Since the turn of the year, Intel has also had a new CEO, Pat Gelsinger, who has been CEO of VMware since 2012 and has spent the first 30 years of his career at Intel. Fundamentally, there is also a lot to like at Intel: Rising revenue and earnings, a stable profit margin of around 25%, EBIT/EV of 9% and Return on Invester Capital (ROIC) of around 20%, i.e. the return Intel has managed to create by reinvesting profits in the business.

A closer look at the ownership structure reveals a few prominent investors: Michael Price from MFP Investors has no less than 15% of the portfolio invested in Intel (though reduced slightly in Q4), Tweedy Brown Co. (Buffett’s old friends from the Graham days) has 0.5% and Daniel Loeb from Third Point has taken a new smaller position of 0.4% in Q4,

However, since the turn of the year, the share price has jumped from around USD 45 to USD 63, which in my view means that the price is now more fair than cheap. But if the company falls back towards 50, it could be interesting to buy up again.

INTC Chart

by TradingView

Buffet's enigmatic purchases...

It’s been in the press this week – which company has Buffett bought in the last few months? Normally, companies like Berkshire are required to disclose their purchases via the US Security & Exchange Commission, but in this case, Buffett has been allowed to keep one or more purchases confidential in Q3 and Q4 2020. On February 16, 2021, it was revealed which companies are involved: communications company Verizon Communication and energy company Chevron.

Buffett has previously owned Verizon, so he knows the company and it fits well in the portfolio as an infrastructure company. The purchase is quite significant at: 8.6 billion. It now represents 3.2% of Berkshire’s total equity portfolio. If we take a closer look at Verizon’s fundamentals, the company has (as of February 20-21) an EBIT/EV (%) ratio of 7.9% and P/B of 3.4, which is relatively cheap in a historical context. At the same time, Verizon pays a 4.4% dividend, which has been steadily increasing over the past 10 years.

VZ Chart

by TradingView

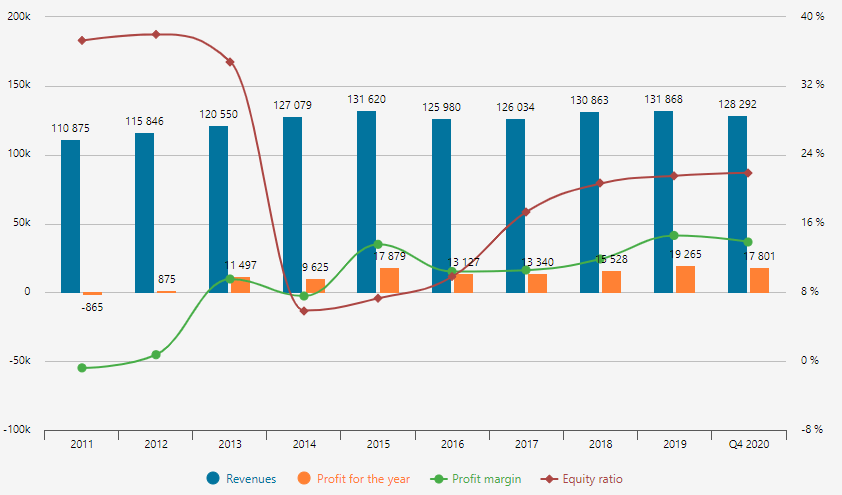

If we look at Verizon’s development over the past 10 years, both revenue and earnings have been stable and especially earnings have been steadily increasing. In addition, the profit margin has evolved from a loss-making business to 10-14% in recent years.

Looking at Buffett’s other activities, he has trimmed ~9% of General Motors and ~6% of his Apple shares. The latter should be seen as a way to balance the portfolio. By the end of 2020, Apple will account for no less than 43% of the entire equity portfolio (!). Talk about concentration.

You can follow Buffett’s portfolio here.

Full transparency: At the time of writing, the author or their close associates have invested in Intel, Berkshire Hathaway and Apple.