A certain degree of market timing.

Looking at

Seth Klarman’s portfolio

for the second quarter of 2022, there’s a pretty clear trend: He’s reducing in a wide range of his positions. These include Alphabet (Google), Intel, Dropbox, Fiserv, Meta, Intel and more than 20 other positions. In other words, the overall picture is that Klarman has taken a more defensive position and is a fairly significant ‘net’ seller of shares here in Q2. This makes it particularly interesting to look at where Klarman is buying up or increasing its positions.

Looking first at the companies where Klarman has bought more, it is primarily concentrated in Liberty SiriusXM’s A (LSXMA) and C (LSXMK) at 7.3% and 4.0% of the portfolio respectively, as well as in Qorvo Inc (QRVO). The latter by just under 5%, so Qorvo remains the second largest position in the portfolio at 10%, despite the fact that the company has fallen significantly in price.

The case for Qorvo

Klarman bought his first position in Qorvo back in 2017 at a price between $65-70 and has increased his position over the past three quarters as the price has steadily decreased. The price peaked in August 2021 at around $195 and has since more than halved to around $195. $92 by the end of August 2022.

Klarman is known to be extremely focused on risk management and the possibility of suffering a permanent financial loss. When he increases an already large position quarter by quarter, it’s because he believes that the case has really only improved after the price has fallen. That makes the case all the more interesting for the rest of us, so let’s dig a little deeper and look at why Klarman thinks it’s such a good investment.

First, a brief introduction: Qorvo develops semiconductors and more specifically “Radio Frequency” chips, which are sold to manufacturers of mobile devices (over 70% of revenue), network infrastructure and defense systems. The company is a medium-sized American company with almost 9,000 employees and a turnover in the last fiscal year of $4.6 billion.

What else can we say about the company?

- The business is healthy: the company has been around for 30+ years and has a relatively low debt to equity ratio. equity of 0.7 (debt-to-equity), which is on par with chip giants such as Intel. Return on equity (ROE) is in the 15-20% range and return on invested capital in the business (ROIC) is around 14%. It’s quite good without being flashy.

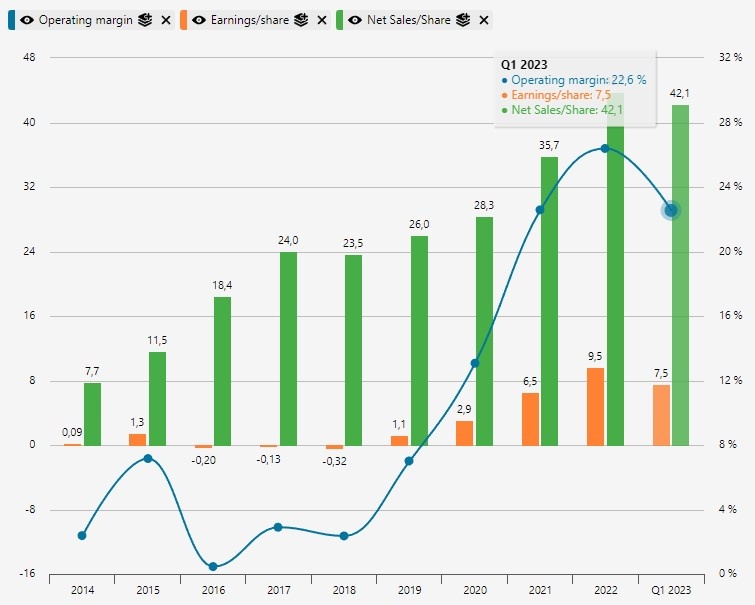

- Over the past five years, revenue has grown by around 9% per year and earnings per share (EPS) has gone from a small loss in 2018 of $0.3 to a profit per share in 2022 of over $9 (delayed fiscal year).

- With a halving of the share price, combined with the fact that the company has only seen a slight decline in revenue and earnings, many of the company’s ratios are historically low. EV/S is 2.5 versus 3-4 historically and EV/EBIT is 11.0 versus 20-40 in the last three years. This gives an earnings yield (EBIT/EV) of 9.1%, which is high for a company that has historically been able to increase revenue by just under 10% per year.

Why the sharp drop in the share price? Currently, chipmakers of all sizes are low on Wall Street’s wish list. After a major upswing during Corona, the demand for online services and mobile phones has dropped significantly, which of course also affects companies like Qorvo, which primarily supplies components for mobile phones. Management’s guidance for the second half of 2022 is a decline in revenue of around 10% and a difficult 2023. In addition, Qorvo has a significant customer concentration in Apple, which accounts for approximately 30% of revenue. Should Apple opt out of Qorvo, it would have serious consequences for Qorvo.

A quick back-of-the-envelope Discounted Cash Flow analysis gives us a fundamental value of around $140. This is about 35% below today’s price and gives us a reasonable margin of safety should any of our assumptions prove wrong (here are mine: EPS = 7.5, discount rate = 10%, growth = 9% in 10 years and 2.5% in 20 years).

For investors with a time horizon of more than three years, Qorvo looks quite interesting.

Two new companies to the portfolio

Klarman has also found room for two new companies in the portfolio here in Q2 2022. One is an old acquaintance, namely Amazon.comwhich is now about 1% of his portfolio. As far as I can go back in Klarman’s history, he hasn’t owned Amazon in the last 10 years, so it will be interesting to see if this is a position he will increase going forward.

The other interesting company that has been added to the portfolio is a significant position in Warner Bros. Discovery Inc. of 3.7% of the portfolio. The company is interesting – both because it is such a large position – and because it is a media company, which is one of Klarman’s specialties. No less than five of Klarman’s top 10 positions are media companies. It’s also a company worth taking a closer look at.

Full transparency: At the time of publishing the post, the author or a related party has invested in Alphabet (Google), Intel and Meta. The author has no positions in the other companies mentioned in the article.

The author or his/her related parties have not received any payment from companies mentioned in this article, nor do they have an employment relationship with the companies mentioned.

As we often write

on this site

, you don’t need to find new unique investments to generate a good return. On the contrary, there is a true goldmine of knowledge and investment ideas hidden in studying the best investors in the world.

You can find all the updated portfolios

here

.