How much should I invest in stocks?

And What About Real Estate or Bonds?

Since the beginning of time, the practical advice has been to divide (i.e. allocate) your wealth into three: one third in real estate, one in business and one readily available – typically in cash or silver and gold. if we go further back in time. It’s still a reasonable starting point. But today’s ease of access to the stock market has allowed individuals to invest in asset classes that either didn’t exist before or were reserved for very wealthy individuals and corporations.

There are four main asset classes: cash, bonds, real estate and equities. The more exotic asset classes such as commodities, currencies and private equity have been excluded as they are not relevant (or necessary) for retail investors. These are the four main asset classes we will take a closer look at. The recommendations are primarily based on the allocation models developed by Burton Malkiel, Professor of Economics at Princeton, David Swensen, Chief Investment Officer at Yale and Benjamin Graham, one of the most respected investors of all time and Warren Buffett’s mentor.

There are two times in a man’s life when he should not speculate: when he can’t afford it, and when he can.

– Mark Twain

Know your tolerance for risk

By far the biggest adjustment to the guide below is your own tolerance for risk. No matter how rational and sensible the allocation guide is, its success will depend on whether you are able to sleep at night. You need to determine whether you’re comfortable with the fact that a large portion of your savings are invested in equities and could fall by 50% – as happened during the 2008 financial crisis. If your temperament doesn’t lend itself to this level of volatility and you get stressed, physically affected or have trouble sleeping in these situations, you should have a smaller stake in equities. If you haven’t experienced this yet, it suggests that you start a little defensively.

We all have a different starting point in life. Some have low incomes, others high. Some live as singles, others in a dual-income family with children. Your life situation should therefore also be taken into account when determining your asset class allocation. If you have a smaller income, physical disability or other factors that make you dependent on an income from your investments or may need it sooner than planned, you should be more defensive and have a smaller stake in equities.

A word of advice: Create an emergency account

Throughout life, we all experience situations that no one could have predicted. We can lose our job, it can start raining through the roof, a loved one falls ill or we need to help a friend in need. That’s why we should always have a minimum of three months’ worth of emergency savings in cash. Do you or your household have monthly expenses of e.g. 30,000, you should have at least 90,000 in cash and immediately available. If you are guaranteed unemployment benefits or wage protection, the amount should be able to be reduced slightly.

Yes, I know that’s a lot of money to have lying around. And yes, you could invest them and earn a return. But think of it as insurance. Whatever happens, you know that you and your family will be fine. It will also mean that you won’t have to sell off your portfolio if something happens just as the stock market takes one of its downturns.

Risk and return are linked

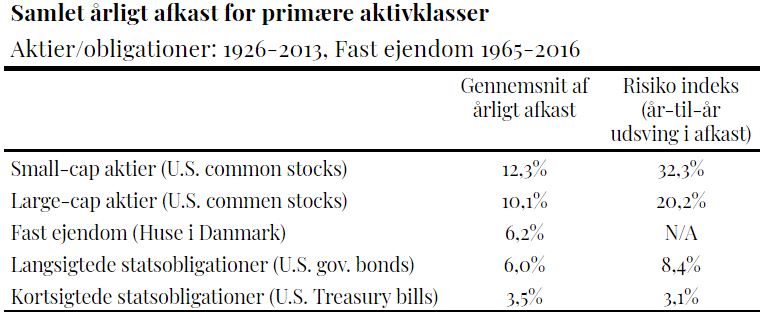

You’ve no doubt heard it before, but history shows that the only way to increase your return on investment is to take more risk. It is a fundamental law of economics and is supported by the last hundred years of historical data, as illustrated in the table below.

The greater the fluctuation in price (here called the “risk index”), the more risk the market attributes to each asset class and the higher the average return. As can be seen in the table, equities provide a significantly higher return than the other asset classes. But it also means that, on average, we have to live with negative returns about every three years if we invest in equities. We can take advantage of this if we have a long time horizon, such as 10, 20 or 30 years.

Your real risk depends on your time horizon

Burton Malkiel, in the book“A random walk down wall street” excellent illustration of the correlation between time and risk, based on US data from 1802-2013. He has calculated that if you only hold on to your investment for 1 year, stocks have outperformed bonds 60% of the time. However, if you hold your investment for 5 years, the probability of a higher return increases to 70%. After 20 years to 91% and after 30 years to no less than 99.4% (!) of the time. We should capitalize on that.

That’s not to say that stocks can’t be risky over long periods of time. However, if you have a 20-30 year time horizon and you reinvest dividends and increase your investments over time, equities are very, very likely to be a better investment with a higher return than the other asset classes.

Lifecycle guide

In practice, this means that your funds should be invested based on your time horizon for when you need the money. For most of us, it will typically be our retirement age that determines when funds will be available. Which today is around 65-70 years. If you expect to stop working earlier, those years must be deducted.

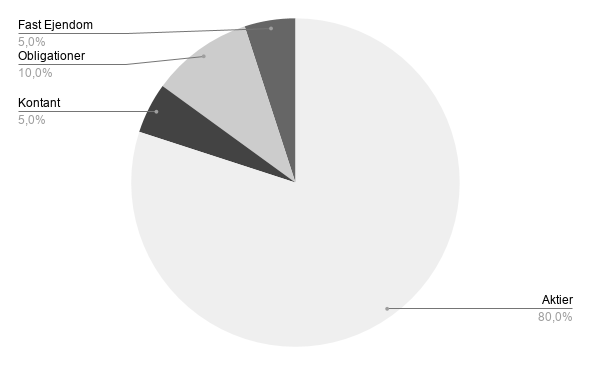

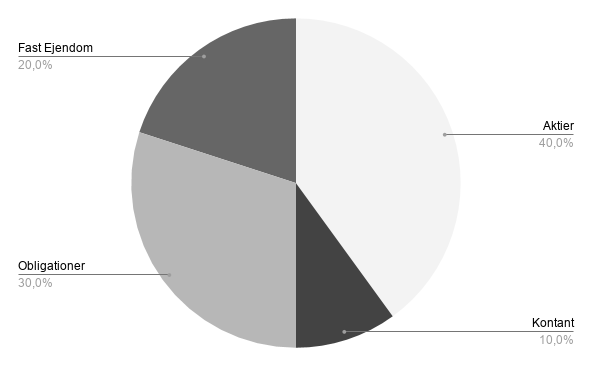

The graphs below show my recommendation for distributing your wealth based on age.

Age: Up to mid-thirties

Allocation:

Cash (5%): In a bank account or in short-term government and mortgage bonds.

Equities (80%): One half in European and American companies, preferably smaller growth companies. The second part in international and emerging markets.

Bonds (10%): Danish investment fund with government and mortgage bonds, possibly foreign government bonds.

Real estate (5%): Danish real estate fund.

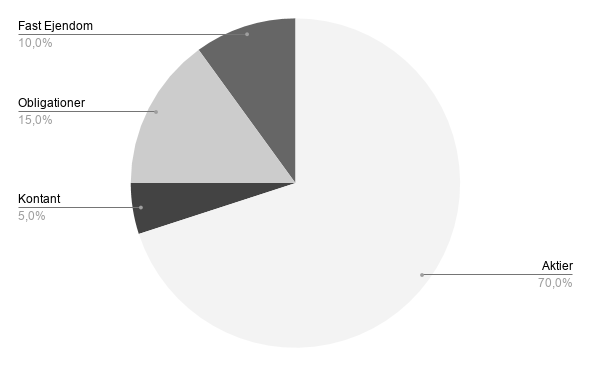

Age: Mid-forties

Allocation:

Cash (5%): In a bank account or in short-term government and mortgage bonds (1-2 years maturity).

Equities (70%): One half in European and American companies, preferably smaller growth companies. The second part in international and emerging markets.

Bonds (15%): Danish investment fund with government and mortgage bonds, possibly foreign bonds

Real estate (10%): Danish real estate fund.

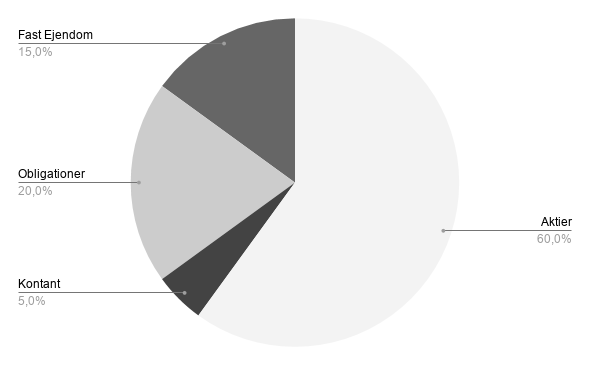

Age: Mid-fifties

Allocation:

Cash (5%): In a bank account or in short-term government and mortgage bonds (1-2 years maturity).

Equities (60%): Two thirds in European and American companies, preferably smaller growth companies. One third in international and emerging markets.

Bonds (20%): Danish investment fund with government and mortgage bonds, possibly foreign bonds

Real estate (15%): Danish real estate fund.

Age: Late sixties and beyond

Allocation:

Cash (10%): In a bank account or in short-term government and mortgage bonds (1-2 years maturity).

Equities (40%): Two-thirds in stable and dividend-paying European and American companies. A third in growth or international markets.

Bonds (30%): Danish investment fund with government and mortgage bonds.

Real estate (20%): Danish real estate fund.