Fiserv Replaces Fidelity National Information Services

Looking down the buy and sell list, Seth Klarman has Klarman has made gsome

significant changes to the portfolio

in the first quarter of 2023.

One of the most notable changes to Karman’s portfolio is the further acquisition of the position in Fidelity National Information Services (FIS) while Klarman sells approximately two-thirds of its Fiserv position. Both companies provide financial infrastructure to banks, businesses and financial institutions. While Fiserv has had a fairly stable development in its share price over the past few years, FIS has fallen and the share price at the end of May 2023 is almost 50% below the level of five years ago.

Klarman bought its first position in FIS back in Q3 2022 and has subsequently increased its stake significantly in Q4 2022 and again here in Q1 2023 to 4.5% of the total portfolio. At the same time, Klarman has sold out of its position in Fiserv from Q2 2022, so it now accounts for approx. 1% of the portfolio after having accounted for 4.8% in Q2 2022.

Flip horizontally to see the graph

The trades are interesting for several reasons. Both companies compete in the Payments industry, which Klarman has followed closely for many years, the FIS position was increased over 100% in Q1 2023, making it the eighth largest in the portfolio and the investment has the character of a ‘special situation’.

FIS acquired Worldpay back in 2019, becoming the largest processing and payment company in the world. After unsuccessfully trying to integrate the two companies, the management team has been replaced and the new management team has made the (undoubtedly difficult) decision to reverse the acquisition by spinning off Worldpay. It is expected that Worldpay will be spun off within the next twelve months, after which FIS shareholders will have an ownership stake in both companies.

The large share price drop is primarily driven by a write-down of FIS’ value of the Worldpay business, which is part of ‘Merchant Solutions’. In February 2023, FIS writes by

announcement of the Q4 2022 financial results

: “

The company recorded a non-cash goodwill impairment charge of $17.6 billion related to Merchant Solutions reporting unit in the quarter.

” Impairment was announced during 2022. Worldpay was acquired in 2019 for $34 billion, so they have basically written down the value by 50% compared to the price they paid four years ago.

The interesting question is what price the market is willing to pay for the Worldpay/Merchant business when it is no longer part of FIS and what FIS will be valued at afterwards. Klarman’s conclusion must be that the combined price for the two companies will be higher than the USD 50-78 he bought up to in Q1 2023.

The tough choice among the tech behemoths

Another interesting change in the portfolio is Klarman’s buying and selling of its positions in the three US tech behemoths Alphabet, Amazon and Meta (Facebook).

On the sell side we find Amazon, which previously made up 1.4% of the portfolio and Meta, which amounted to 3.5%. Amazon was acquired in the second quarter of 2022 and Meta in the first quarter of 2020 and have now both been sold. In addition, Klarman has sold its position in memory manufacturer Micron (previously 2.8% of the portfolio).

On the buy side, we find Alphabet (Google), which was first acquired in the first quarter of 2020 and has since been both increased and reduced. However, in the fourth quarter of 2022, the Alphabet position was significantly increased by almost 200% (approx. 2.6 million shares) and then again in the first quarter of 2023 by a further 47% (approx. 1.9 million shares), making it the second largest position in the portfolio and more than 10%.

Flip horizontally to see the graph

As can be seen in the development of the share price, Google – like many other tech companies – has faced some headwinds in 2022. The price peaked at the end of 2021 at 148 USD and fell to around 88 USD by the end of 2022, a drop of more than 40%. During that period Klarman bought in the range of 83 to 108 USD, which is expected to have given him an average purchase price around 95 USD. In other words, this is the range in which Klarman believes Alphabet is trading below the company’s fundamental value – after deducting a margin of safety of at least 20%.

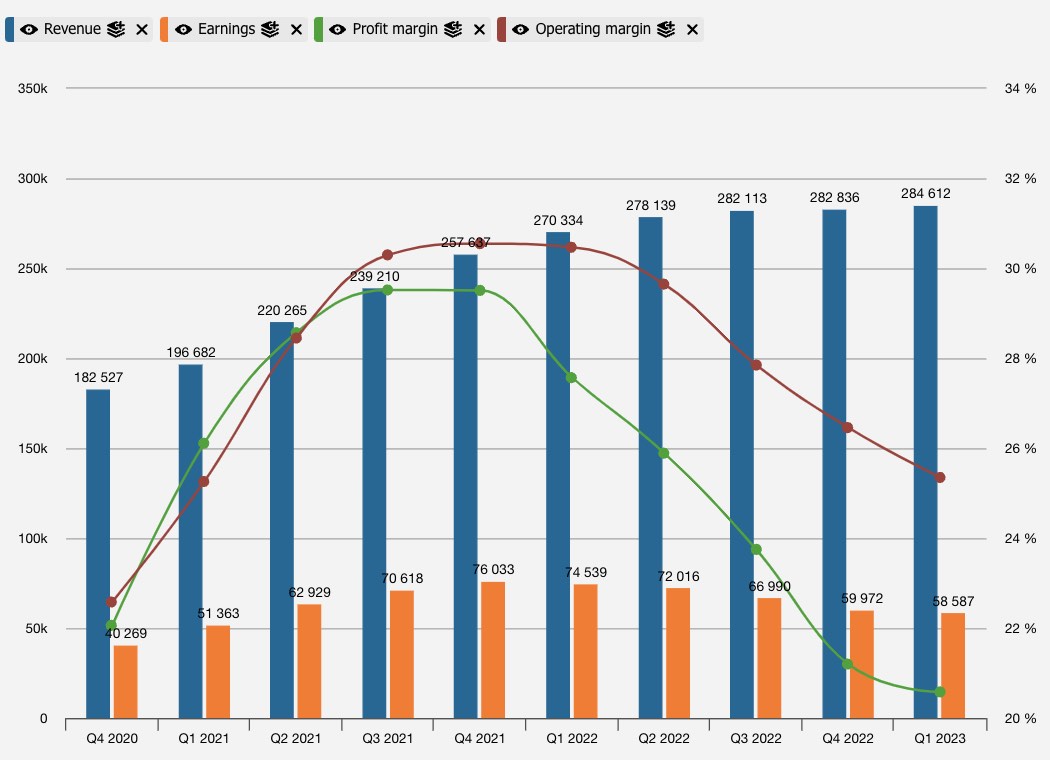

Looking at the underlying business, Alphabet has certainly faced headwinds in recent quarters. The decline in advertising revenue, which is the vast majority of revenue and earnings, has decreased as the economic landscape has become more uncertain and many businesses are spending less on marketing and costs in general. Add to this the strategic challenge in the wake of Microsoft’s introduction of ChatGPT and the increased search functionalities of their online search portal ‘Bing’.

Looking at Alphabet’s actual financial figures, the challenges have been less pronounced than the large drop in the share price might indicate. Revenue per share is actually risen throughout the period. Not the +10% we’ve seen in the past, but still 1-2% every quarter. Earnings per share, on the other hand, have fallen for five consecutive quarters, the worst in Q3 and Q4 2022 with declines of 6% and 10% respectively. This has led Alphabet to cut costs and has resulted in

12,000 employees to be made redundant

.

It will be interesting to see if earnings growth returns and margins pick up later in 2023. Seth Klarman has at least assessed that the challenges are temporary and made a significant investment.

Full transparency: At the time of publishing this post, the author or a related party has invested in Alphabet, Apple and Meta. The author has no positions in the other companies mentioned in the article.

The author or his/her related parties have not received any payment from companies mentioned in this article, nor do they have an employment relationship with the companies mentioned.