ATP: Reasonable result for 2023 and a look towards 2024

ATP’s management team dives into the financial figures for 2023 and shares their assessment and expectations for the investment year 2024.

You are here: Home || ATP

ATP’s management team dives into the financial figures for 2023 and shares their assessment and expectations for the investment year 2024.

ATP has just released their half-year report for 2023. We dive into the numbers and look at the changes that have been made from the end of 2022 to now six months later.

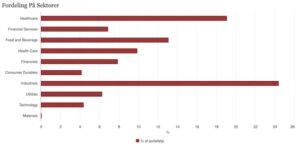

See which sectors investors are buying into and selling out of and in which sectors they are most concentrated.

New and improved portfolios It took some legwork, but all portfolios are now updated in a consistent and expanded format. This means that you can now gain insight into the

2022 was an unusual year. For ATP, sharp interest rate increases and large equity declines resulted in extensive losses on our investments. The rare combination hit ATP hard, but pensioners’ payouts are unchanged. ATP pays out the pensions we have promised our members.

With an investment of a large, triple-digit million DKK amount in the Danish renewable energy company Better Energy, ATP makes one of the largest investments of the year. The investment is part of ATP’s ambition to strengthen the development of green, Danish-produced energy and contribute to the green transition.

Turbulent financial markets had a pronounced impact on the first half of 2022. Rising interest rates and falling equity prices resulted in a negative investment result for ATP, but do not cast doubt on the fundamental security of the guaranteed pensions.

For the third time, ATP invests in Swedish Northvolt, a developer and manufacturer of the world’s greenest electric car batteries. The Danish pension fund invests DKK 400 million and the total investment from ATP now reaches DKK 1.9 billion.

ATP’s efforts to obtain ESG data from the unlisted area of the investment universe are growing. Industriens Pension and PenSam are now joining ATP’s questionnaire for funds and unlisted companies in order to push for more sustainability in the portfolio. Data is crucial for the pension sector to deliver on the ambition of value-creating ESG integration, including contributing to the green transition by reducing CO2 emissions in all parts of the business.

A targeted investment strategy and tight risk management meant that ATP once again generated record results in 2021. The investment return of almost DKK 50 billion has never been higher, and after the high returns of the last three years, there was room in 2021 to increase pensions by DKK 30.4 billion, which is also the largest increase ever.

Hot water from deep in the Earth’s interior will provide renewable energy in the detached house. The geothermal plant, which will be the largest in the EU, will now be established in Aarhus. ATP is a major investor in the project and thus plays a crucial role in exploiting the world’s fourth renewable energy source here in Denmark.

“We simply can’t afford not to”. This is the message from ATP’s CEO. Bo Foged. ATP is raising its climate ambitions to create good returns for its members and contribute to the global green transition.

Despite rising interest rates at the beginning of the year, ATP once again generated record returns. In the second quarter of 2021, ATP achieved the best return in the investment portfolio ever, so the financial reserves at half-year with DKK 171 billion are record-breaking, and the bonus ratio is 22.8 percent.

Despite rising interest rates at the beginning of the year, ATP once again generated record returns. In the second quarter of 2021, ATP achieved the best return in the investment portfolio ever, so the financial reserves at half-year with DKK 171 billion are record-breaking, and the bonus ratio is 22.8 percent.

With ATP Langsigtet Dansk Kapital, the Danish pension company is ready with up to DKK 6 billion to support the development of new or existing Danish companies. The ambition is to create high returns, growth and jobs in Denmark by supporting the long-term development of several positions of strength in Danish business.

ATP, Swiss Swisscanto Private Equity and BankInvest are among the investors who are now injecting DKK 180 million into Danish MedTrace, which specializes in the treatment of heart patients.

A targeted investment strategy, clear contingency plans and tight risk management contributed to ATP once again achieving a record result in 2020 in a very unusual and turbulent year.