We are now officially in a bear market, which means that the major indices have fallen more than 20% from peak to (so far) trough. The NASDAQ has fallen more than 30%, the S&P500 by about 23% in mid-June and is now down about 18% this year, and our Danish C25 has basically just followed the S&P.

Investors’ fears are palpable and hardly a day goes by without more bad news: Inflation continues to be at its highest level since the seventies in both the US and Denmark, when it reached 10-15% per year. As a result, central banks have been forced to raise interest rates to fight inflation, which has led to losses on bonds (when interest rates rise, the price falls). In addition, there is still war in Europe, new Corona variants are lurking in the fall and many countries are in a situation that could easily end in economic recession (typically defined as negative GDP for two consecutive quarters). Phew, not exactly a dream scenario for us investors and it’s no wonder it can be difficult to stay optimistic at times.

Rather than going off the deep end, let’s look at what history can teach us about similar – if never the same – situations (hint: there’s actually a silver lining!).

The base case after a bear market

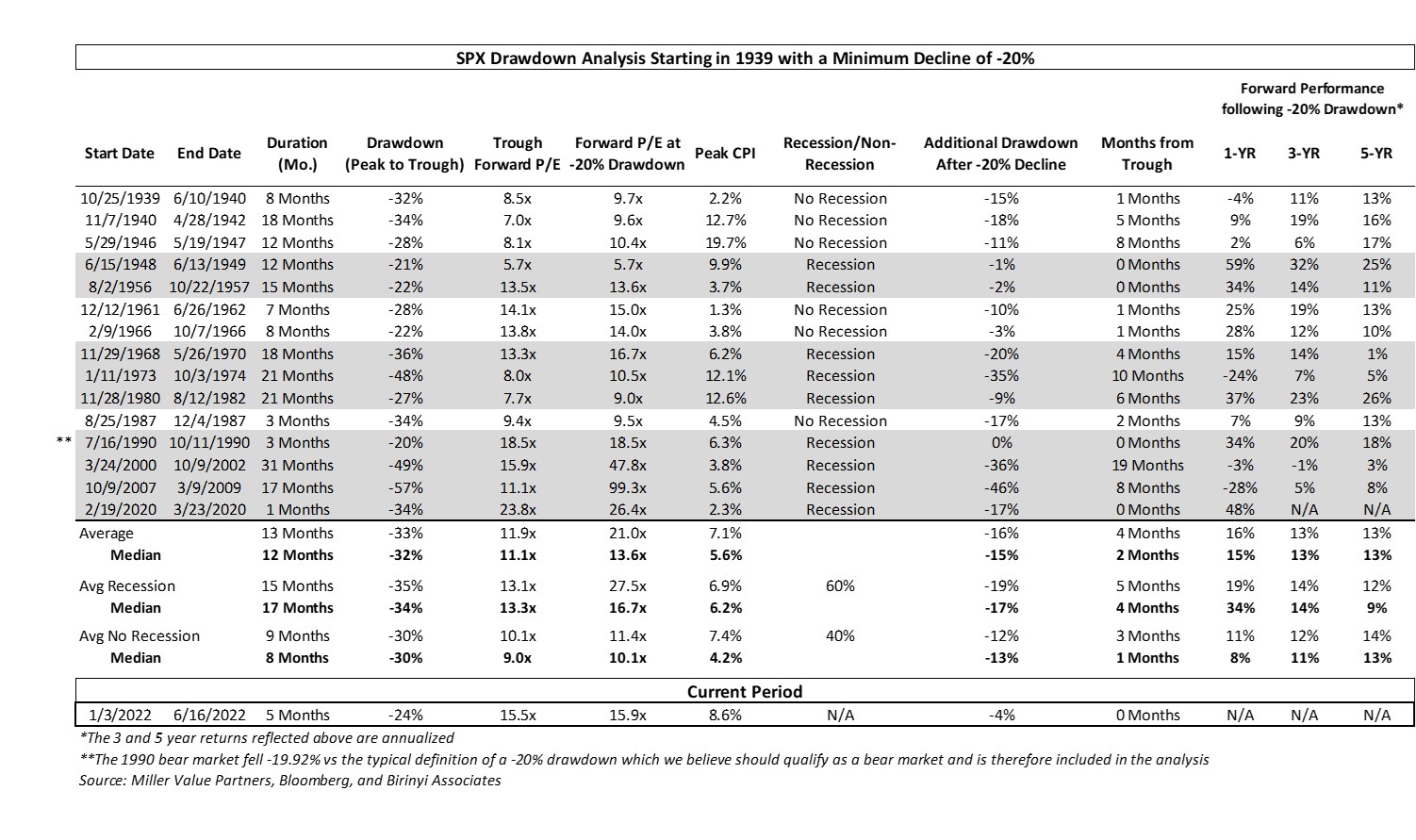

For the purposes of our analysis, Miller Value has kindly compiled a dataset that looks at all periods from 1939 onwards where the S&P500 has experienced a minimum 20% percent decline.

If we look at the actual figures for all bear markets since 1939, the bad news is that we typically see declines of 30-35%. This means we should prepare for further declines of 10-15% over the next 3-6 months. Not exactly a dream scenario for all of us who have our money invested… But if we take a longer time perspective, there are good odds of getting a high return in the next 1, 3 and 5 years, where historically there has been an average return of between 12 and 14 percent per year (!).

The Case for a Major Economic Downturn (Aka Recession)

And then you might think – Well, that all sounds great, but what if this turns into a serious recession in the US and Europe? The short answer is that historical returns have actually been

higher

after a recession. Here, the market has returned 19% on average over the following year and 12-14% per year on average over the next 3-5 years. So while there are typically larger short-term declines in store if we enter a recession, we’ll be compensated when we come out the other side. Even in the event of a recession, we see great returns over a 1-year period in 2/3 of the cases.

What do Worst Case Scenarios look like?

In addition to knowing the ‘base case’, i.e. the typical scenario, it can give us some perspective to look at the worst-case scenarios that have played out over time. How bad can it really get if it really hurts? Three periods in particular stand out:

- 1973-74 in the wake of the energy crisis, which contributed to very high inflation (up to 15% per year) and saw the market fall a further 35% from bear market (i.e. 55% overall). Not exactly a wishful scenario and unfortunately with some similar assumptions to what we see today. This may also explain why the market has reacted so strongly to the high inflation we see today. However, it’s worth noting that even in the ’73-74 period, returns after 3 and 5 years were 5-7% per year. Not bad at all.

- In 2000-2002 after the dot-com bubble, the market fell a further 36% from the bear market (i.e. 56% overall). Here, losses were driven by the huge falls in tech and telecom companies, which had been traded up to extreme levels, while other sectors saw much smaller losses.

- In 2007-2009 during the financial crisis, the market fell a further 46% from the bear market (66% overall!). Here, the entire financial system was collapsing in the wake of the subprime scandal and the banks’ (and therefore their customers’) assets were in real danger. It’s hardly a similar situation that we find ourselves in here in 2022.

Time horizon is everything

The price of getting the long-term returns that the stock market offers is that we have to live with scenarios where our portfolio could fall 50 or even 60%. It’s important to remember that even a 20% drop can leave us feeling a little depressed. At the same time, it is extremely important to remember that even the worst periods of the last 80 years have yielded annual returns of -1% to 3% per year for the following 3 and 5 years. There is

no

precedent where we investors have lost money 5 years after a bear market.

Sure, it’s not fun to get a 0% return like in 2000-2002 while there is inflation, but it’s quite impressive that returns have always been positive, as long as the time horizon is 5 years. Back in 2000, there were many parts of the market other than tech that were quite rationally priced and those sectors performed far better. In other words, a disciplined focus on valuation provided significant protection.

Bottom line

In a historical context, the main conclusion is that with can most likely look forward to more than satisfactory returns over the next 1, 3 and 5 years. Regardless of whether we have a recession or not. In other words, it makes sense to buy when the price is low – even if it feels horrible and stocks continue to fall.

If you also keep an eye on the companies’ valuation versus price, you can avoid some annoying drops when the market reassesses the multiples. For example, if a company trades with a P/S (price-to-sales) of over 40, as some growth companies did in 2021, an incredible amount has to go well to live up to expectations. Many are now down 50-80% by 2022.

Patience and a rational mind are important virtues. Especially as an investor.