Here you’ll find the best resources to support and improve your investment process: identify investment ideas, analyze companies and follow legendary investors. These are all resources that I use myself in my investment process and would recommend to others.

The cost of the resources is taken into account, as few private investors can justify spending e.g. ~150,000 per year for a Bloomberg terminal (although they are lovely with their 80s look). Fortunately, that’s not necessary today. There are a number of resources that can often go above and beyond and are either free or priced at a level that private individuals can afford.

(Full transparency: I receive no direct or indirect compensation from the sites below.)

Selected online services

Börsdata.se

Stock market data is my primary tool for screening companies and doing the quantitative analysis based on company key figures. The site is Swedish, but has an English version. They typically have 10-20 years of data on companies and provide a wide range of key figures, discounted cash flow calculations, technical analysis, etc.

The site has the distinct advantage of being relatively inexpensive for private investors compared to other sites. the professional programs such as Bloomberg. Depending on your needs, they have three pricing models, all of which have something to offer. I used the free version myself and bought premium for a few months. But now I’ve grown so fond of the site that I always use pro, which has global company data.

Price: Free, Premium (€9/month) and Pro (€25/month).

Link: https://borsdata.se/

Morningstar.com

On Morningsstar you’ll find a range of interesting data sources and analytics. Morningstar has been around for many years, and there is both an international/American site (.com) and a Danish version (.dk). I use the international one in particular to read analytics and every time I analyze a company. They have gathered the relevant key figures and have +10 years of history for virtually every company in the world.

In addition, Morningstar provides a quantitative or qualitative fair value assessment of companies for paying customers. It’s a service that I’ve benefited from and can recommend to others to learn from. But it’s not necessary to use the wealth of data available on their site.

Price: Free, Premium $199/year

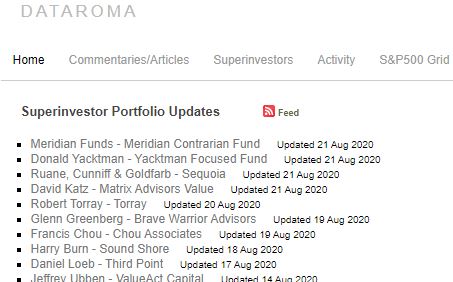

Dataroma.com

Dataroma follows the portfolios of a wide range of legendary investors, such as Warran Buffett, Seth Klarman, Howard Marks and Tweedy Browne. Although these are primarily US investors, the portfolios are global and a number of them also own Nordic companies.

Their data is based on financial reporting to the authorities (SEC via 13F filings) and is consolidated and presented in an easy-to-read format. Dataroma is thus an effective way to find new investment opportunities and learn from the best active managers in the world.

Price: Free (revenue based on advertising)

Link: https://www.dataroma.com

Gurufocus.com

Gurufocus is primarily a quantitative platform that allows for advanced screening and analysis of companies. The site has automated an extensive library of metrics and analytics models inspired by renowned value investors such as Peter Lynch, Graham and Buffett.

I use the free version myself when analyzing companies, as some of the models are also covered by Börsdata Pro. However, there are other interesting key figures, insider buy/sell lists, etc. that are not easily available elsewhere. An excellent supplement or primary site if you can live with the slightly high price tag.

Price: Free, Premium: EU: $399/year, USA: $449/year, Asia $399/year

Yahoo Finance

Yahoo! finance is primarily a news site, but they also have some interesting company data. Of particular interest is their “Analysis” tab, where you can see the number of analysts covering a given company, their estimates of earnings, revenue and target price, as well as their buy/sell recommendations.

Price: Free