Let’s be clear: analyzing a company and making an investment decision is not easy. Not if it’s done properly (and it should be!). It requires knowledge of the specific sector, knowledge of the company and its products, competitors, management and economic conditions. And not least, that you are able to value the company.

The best solution for the vast majority of private investors will therefore be to buy one or more index funds rather than hand-picking the companies themselves. But since you’re reading this site, you probably have the courage to dive in and analyze specific companies. So let’s get started:

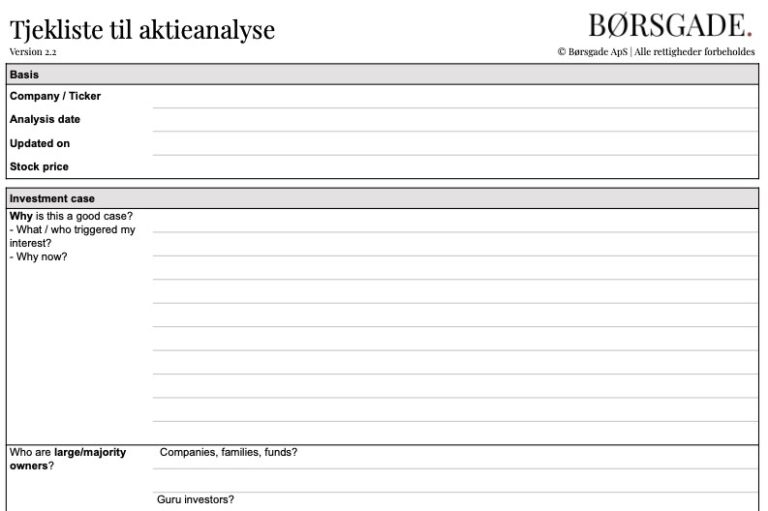

- The checklist has been developed over a number of years and can be used as a starting point for analyzing a specific company in any industry .

- It is based on the way Warren Buffet and some of the best investors have structured and optimized their investment process. This knowledge is taken from investment books, annual reports, letters to shareholders, interviews, etc.

- The list is made as short as possible without compromising on the most important areas any analysis should cover. The purpose is to identify the main characteristics and risks for the company.

- The checklist is an excellent tool to document your considerations and later learn from your mistakes and successes. Remember: It’s the process that matters, not just the result.

- In its current form, there is no guideline or explanation for each item. In other words, using the checklist requires some insight. But no matter where you are in your investor journey, this list is useful. As inspiration to write your own, as a springboard to learn more or as a concrete tool in your investment process.

- The checklist is written in English as the vast majority of my sources are American and the best online services for stock analysis are in English.

- And last but not least: Don’t be too hard on yourself. Analyzing companies takes time and practice. If you only have a few hours to do the analysis, start with that. Invest a small amount initially and increase it as you get to know the industry, company and management better. It’s better to do a simple analysis than no analysis at all.

I use the checklist myself before every purchase or sale of a company and you should do the same. I work with one document for each company and update it as I go along. The reason I chose the PDF format is that it’s quick to make a copy and write notes by hand on your iPad, Surface or similar (or print on paper).