Title: The Motley Fool Investment Guide: How the fools beat Wall Street’s wise men and how you can too

Author: David & Tom Gardner (D&T Gardner)

Published: 2017 (Third edition)

Buy the book here: Saxo.com or amazon.de

Why should I read it? You are a private investor who wants a practical and accessible introduction to equity investing and a deeper understanding of growth companies.

The weight of the book is rightly placed on the two authors’ framework for finding and analyzing companies, called “An everlasting approach to investing” (Tom) and “Breaking the investment rules” (David). The fact that many passages are written with a twinkle in the eye only adds to the reading experience.

David & Tom Gardner

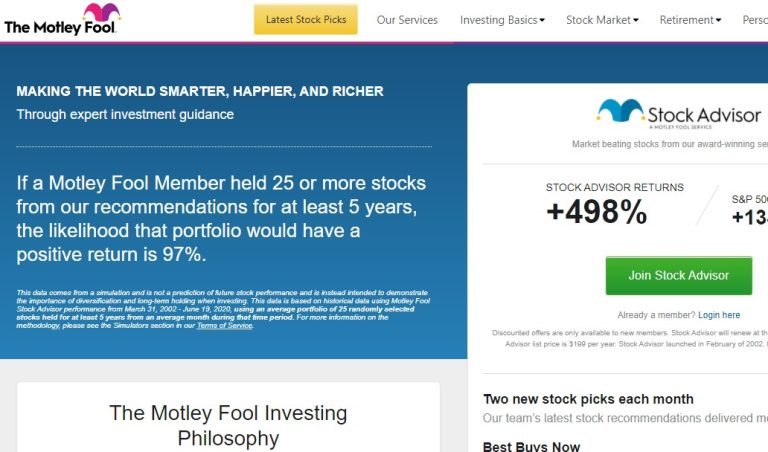

Tom and his younger brother David Gardner are the founders of the popular investment site The Motley Fool, where Tom is currently CEO.

They started the site in 1999 with the simple aim of teaching others about saving and investing. Their investment philosophy is based on long-term investment in a small number of carefully selected growth companies.

The jesters of the investment world

The term “Motley Fool” is taken by D&T Gardner from Shakespear’s comedy“As you like it“. Like Sharespeare’s court jester, the Gardner brothers want to be able to tell kings and queens (or all of us) the truth that no one else dares to say for fear of losing their heads (or their jobs on Wall Street). Their philosophy is one part humor and one part truth. Not a bad starting point at all. In addition, they now have a 30-year track record with returns significantly above the major indices.

The Gardner brothers’ book is in many ways a primer on investing: there are sections on investor psychology, discussion of the pros/cons of different types of assets (mutual funds, index funds and individual companies), small cap versus large, etc. However, the focal point of the book is the two authors’ framework for finding and assessing specific companies, where we will dive into one of the two investment approaches and draw out the key points.

In addition, the book contains quite in-depth chapters on two advanced topics; Shorting (going short a stock) and buying/selling options.

In the final chapter of the book, they summarize their approach quite clearly:

“Find the companies and the leaders you trust. Explore the businesses that are changing the landscape of their industry. See if you can uncover a small-cap hidden gem, then watch as it blossoms into a major player. Take advantage of all the reasearch tools at your disposal – both the obvious ones (like financial statements) and unexpected ones (like online videos) […]. And then hold on for the long term, ignoring the noise as best you can.”

And how do you do that, you might ask? Let’s look at the more interesting of the two approaches recommended in the book.

The evergreen approach to investing

Before reviewing D&T Gardner’s criteria and process for ‘The everlasting approach’, it is important to understand their basic investment philosophy. One of the key attributes highlighted is the ability to hold a stock for a long period of time. Here they are inspired by Peter Lynch’s ‘multibaggers’, where the point is that some of the growth stocks bought for the portfolio could rise 10 times or even 50 or 100 times the purchase price. These companies will fluctuate in value over time, and if we as investors sell in the hope of buying them a little cheaper later, chances are we’ll never do so. Simply because many investors find it difficult to pay a higher price than they have previously purchased at. Regardless of whether the business has had a corresponding positive development.

For this reason, authors are very long-term in their investments. Once they have found and bought a company, they keep them for a minimum of five years and preferably much longer.

five principles for an excellent investment

D&T Gardner’s approach to investing is fundamentally sound and doesn’t really differ from many other recognized investors’ frameworks. What separates their approach is really the prioritization of the five principles. Because while perhaps 98% of the world’s investors start with valuation and filtering companies based on various key figures, the authors start by looking at the culture and strategy of the companies.

The basic reason is that they want to find companies that can grow over the next several decades. And here it’s crucial that the company’s culture and strategy support a similar long-term journey for the company – which doesn’t always show up in the key figures. The five principles are:

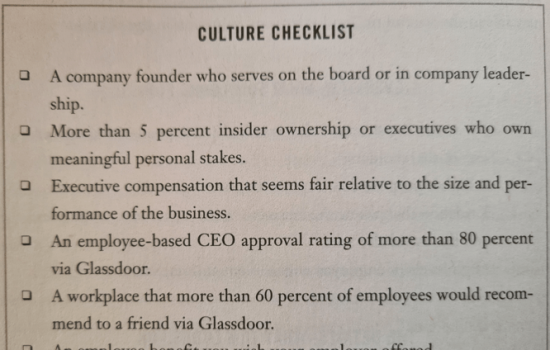

1) Culture: Culture is basically all the connections that happen in an organization: between employees, managers, suppliers, customers, shareholders, etc. Companies that focus on treating all their relationships fairly tend to be successful in the long run.

The primary questions are: How does the company’s CEO act? Are financial interests aligned between management and shareholders? Are employees happy and how long are they employed?

2) Strategy: Every business has competitors. Therefore, as an investor, it is critical to know the company’s competitive advantages (and weaknesses). The two primary issues here are the company’s pricing power and its competitive advantage – or ‘moat’ as Buffett would say.

The main questions are: Can the company increase prices without losing customers? How big is the market when we look 5 or 10 years ahead (also known as Total Addressable Market / TAM)? How loyal are customers? How good is management at allocating capital?

3) Economy: The primary factor here is growth in company sales. Without long-term revenue growth, preferably 15% or more, it’s difficult to increase profits decades down the line. Similarly, it is important that the company is able to provide a reasonable return on equity (ROE), which according to D&T Gardner is a minimum of 10%. In practice, this means that for every krone you invest in the company, it gives a return of at least 10 øre.

A company can have a great culture and many competitive advantages, but if it has a lot of debt and a few tough years of adversity, it may not survive. Therefore, it’s also important to ensure your company’s debt is not too high. These various ratios can be found in companies’ financial statements and on online services such as Morningstar.

4) Safety: All stock investments involve risk for us as investors. Some higher than others, but there are no risk-free investments. Therefore, it is critical to explore and estimate the various challenges that the specific company may face along the way. For example, what happens if the CEO leaves? Is the company proactive about to ensure it is not replaced by new products or services (disruption)? Does the company have the opportunity to continue its growth or is the market becoming saturated? Does the company have a good mix of suppliers and customers?

5) Valuation: This is based on the current share price and what it assumes. Does a given share price mean that the company must increase its revenue and earnings 30% in 10 years to justify today’s price? If so, how likely is this and what is the industry average (“base rate”)?

A couple of interesting points here is that D&T Gardner doesn’t just look at the reported earnings in the financial statements, but looks at “owner earning”, which is basically the earnings the company would have if it didn’t need to grow. In addition, they estimate revenue and earnings per share growth for the next 5-10 years and only buy companies that provide an annual return of 15% or more.

Practical implementation of the strategy

One of the practical challenges with the authors’ approach is that we as investors must first compile a clear list of companies that have the potential to fulfill the 5 principles. There are tens of thousands of publicly listed companies and it is not practical to assess the culture, strategy, etc. of every company. Therefore, before we can actually apply the five principles, we need to make our list of possible candidates small enough to explore them in depth. The authors don’t provide much help here, but a good option is to follow what other legendary investors are doing, like we do here at Børsgade. Alternatively, we can use a few of their key figures to screen for interesting companies, e.g. revenue growth above 15%, ROE above 10%, low debt, etc.

Once we have found the companies that meet the criteria, we will typically end up with a number of companies that are quite expensive based on normal fundamental ratios such as P/E, P/S and P/B. However, if the price is reasonably acceptable, one way to mitigate the risk of paying too high a price is to buy into the companies over a longer period of time. Preferably when they occasionally drop in price. A good example is here at the end of January 2022, where several of the companies mentioned in the book have fallen 10-20% from their 2021 peak. Another example was during COVID-19 in February-March 2020, when many of them dropped 30-50%. However, this approach assumes two basic things:

1) As investors, we always have a certain portion of our portfolio in cash (or short-term bonds). Without it, we have nothing to buy when the opportunity arises. In practice, I would recommend 5-15% of the portfolio. An alternative approach is to continuously set aside money for investment, for example by investing a fixed amount every quarter in the selected companies.

2) That we as investors accept that some companies are relatively ‘expensive’ from a fundamental approach and will likely remain expensive for a very long time, e.g. measured by Price to Sales (P/S) or Price to Earnings (P/E) values.

The second point in particular can be difficult for those of us who like to buy companies at a price significantly below the company’s fundamental value, and at the same time don’t want to project growth over the next 10 years of perhaps 15% or 20% to justify a given market price. Thomas Gayner from Markel is a good example. His solution is simply to buy smaller portions of the companies over a long period of time, typically over the course of many years. In this way, he gets “dollar cost average” into his selected growth companies.

Which companies meet the criteria?

Finally, it’s worth highlighting the companies that D&T Gardner mentions in the chapter with the ‘eternal approach’ to investing. These companies met the criteria at the time of publication (2017) and are therefore a good starting point to build your own list and see what such a company looks like in practice. The companies are (drum roll): Google, Chipotle, Starbucks, Whole Foods and Facebook.