The pandemic that ended a decade of stock market celebrations

2020 was a challenging year for all of us. The Corona virus has forced us to change our everyday life and behavior. Unfortunately, it has also been a year where many have been affected by illness. Both directly and indirectly. For most of the year, this has created a high degree of uncertainty about the future. Both on a personal level and in the stock markets.

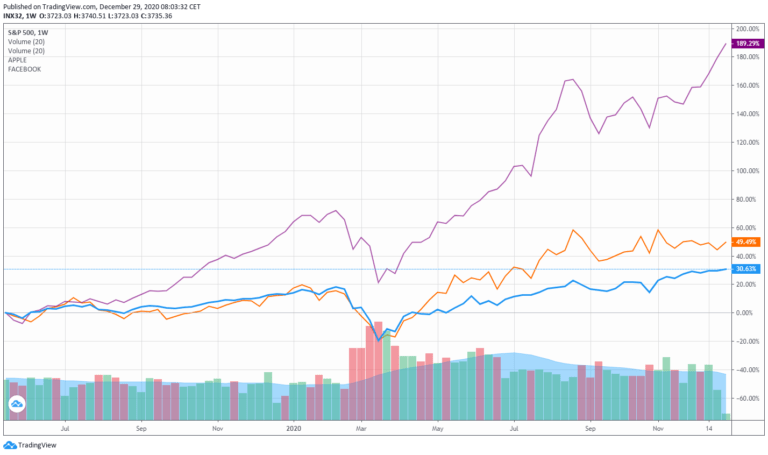

At the beginning of the year, no one knew how widespread the Corona virus would become or how dangerous it was to get infected. When the markets realized that a global pandemic was a reality, it led to one of the largest ever daily decline in the leading stock indices. The S&P500 fell no less than 11.98% in a single day – only surpassed by the biggest drop during the 1929 depression and ‘Black Monday’ in 1987.

Over the following weeks, the major indices fell by more than 30% and no one knew how far down we were going. There was talk of taking the elevator down. Daily fluctuations of 5-10% were normal in those days. However, the market had been on an upward trend for more than 10 years in a row, so there was little to take away.

Uncertainty about the future is not the definition of risk

In the period from early February to mid-March 2020, when global markets fell 30-40%, it is notable that companies like Apple and Facebook also fell to the same extent. Sure – there were certainly concerns about the impact on the economy, whether there would be bailouts, interest rate cuts, etc. But with a virus that is contagious by physical presence, one might be tempted to think that companies that thrive on online social interaction and online services would be less affected. Maybe even stand to gain a financial advantage.

The probability that we as investors would suffer a permanent financial loss (=risk) by investing in, for example, Apple or Facebook in March 2020 versus January 2020 was hardly higher. So why did these and similar companies fall almost as much as the entire market? Basically, market participants measure risk in volatility – i.e. fluctuations in prices. And in February, no one knew how much of a drop we would see: 20%, 30% or maybe 50%? Could we expect a temporary recession or even a year-long depression?

This leads me to the following point: if there’s one thing the market doesn’t like, it’s uncertainty about the future.

Uncertainty scares us investors (and more normal people) and creates the fear that ‘no price is too low’. The rational and long-term investor, on the other hand, thinks:

1) Good thing I’m never 100% invested in stocks – then I have some funds to invest (in my case, about 20% of the total portfolio)

2) I have the opportunity to buy high-quality companies at a significantly lower price (= lower risk).

3) Market corrections throughout history have never been permanent (capital losses = temporary)

It requires a little insight into market history and, most importantly, a strong stomach when it counts. When the market falls, it effectively means that every single stock you buy drops in price. Day after day. Not exactly an uplifting experience, let me tell you! But necessary for the simple reason that no one knows when the bottom is reached. On the other hand, you can look forward to buying good companies at a lower price. That’s how good returns are made!

An effective rescue plan

Fortunately, many positive things have also happened in the past year. First and foremost, the Danish healthcare system has shown itself at its strongest. Doctors, nurses and caregivers have been at the forefront of the fight against Corona, despite the personal risk involved. The Danes have shown that we can stand together and look after each other when it really counts. This has meant that fewer Danes have fallen ill compared to many of our European neighbors.

At the same time, politicians and national banks – both in Denmark and globally – managed to react promptly and to such an extent that it has proven sufficient to counter the worst economic consequences of the crisis. In my opinion, it has been both competent and impressive.

The road from here

The combination of extensive economic stimulation, a significant reduction in interest rates and successful vaccine development has led to a market situation where prices are now back to all-time highs. Here at the end of the year, the various asset classes (bonds, stocks, real estate, etc.) are sold at valuations that are significantly above normal. The only exceptions are industries that actually seem to have higher risk, such as energy (oil/gas), hotels and commercial real estate.

Combined with historically low interest rates, this presents one dominant challenge for investors in 2021: an assumption of the lowest returns ever . At the same time, markets will be more exposed if there is another external shock: Virus mutation, natural disaster or something else we haven’t thought of yet. At this point, governments and central banks will not have many levers left to pull.

In such a market, my personal tendency is to lean towards a more defensive portfolio composition. That doesn’t mean I’m selling everything I own and going all cash. But this means that I’m taking some of the return out of the market and have started putting money aside. Something in the range of 10-25% of the portfolio would be appropriate.

The situation isn’t extreme – prices aren’t horrible (assuming interest rates stay low, which they probably will in the coming years). But it’s difficult to find good companies at a fair price. Not to mention low prices.

Wishing you a happy new year

Two days ago, the first Dane was vaccinated against the Corona virus and over the coming months, an ever-increasing proportion of the population will be vaccinated. So while the expected return on the market can best be described as measured, it does offer hope for the future!

The year 2020 was also the year Børsgade was launched. I would like to thank the friends and kind souls in the family who took the time to provide input, read reviews and offer constructive criticism. It’s appreciated. I look forward to an exciting 2021 here on the site.

With those words, I would like to wish you all a Merry Christmas and a Happy New Year!