Investment in customer service, IT infrastructure and game development

In the latest Q2 update of Tweedy Browne’s International Value Fund, which we follow on this site, they have added some interesting companies to the portfolio.

As is often the case with Tweedy’s investments, these are small and medium-sized companies trading at share prices significantly below what Tweedy considers to be fair value based on the companies’ fundamental value. Let’s take a look at their new purchase.

Teleperformance SE: Customer service at value prices

One of the new companies in the portfolio is French company Teleperformance, which helps their customers outsource what they call “customer experience management services”, which covers a wide range of different areas such as technical support, visa applications, debt collection, interpretation and translation services and various back-office services.

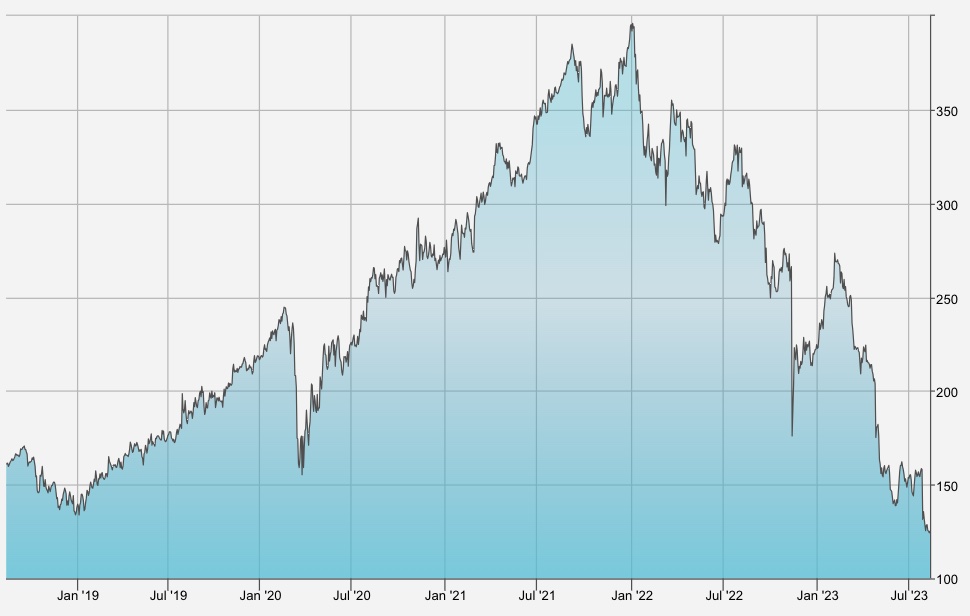

Since the share peaked in early 2020 at 390, it has since fallen significantly and is now trading around 125. In the last year alone, the share price has fallen 60%.

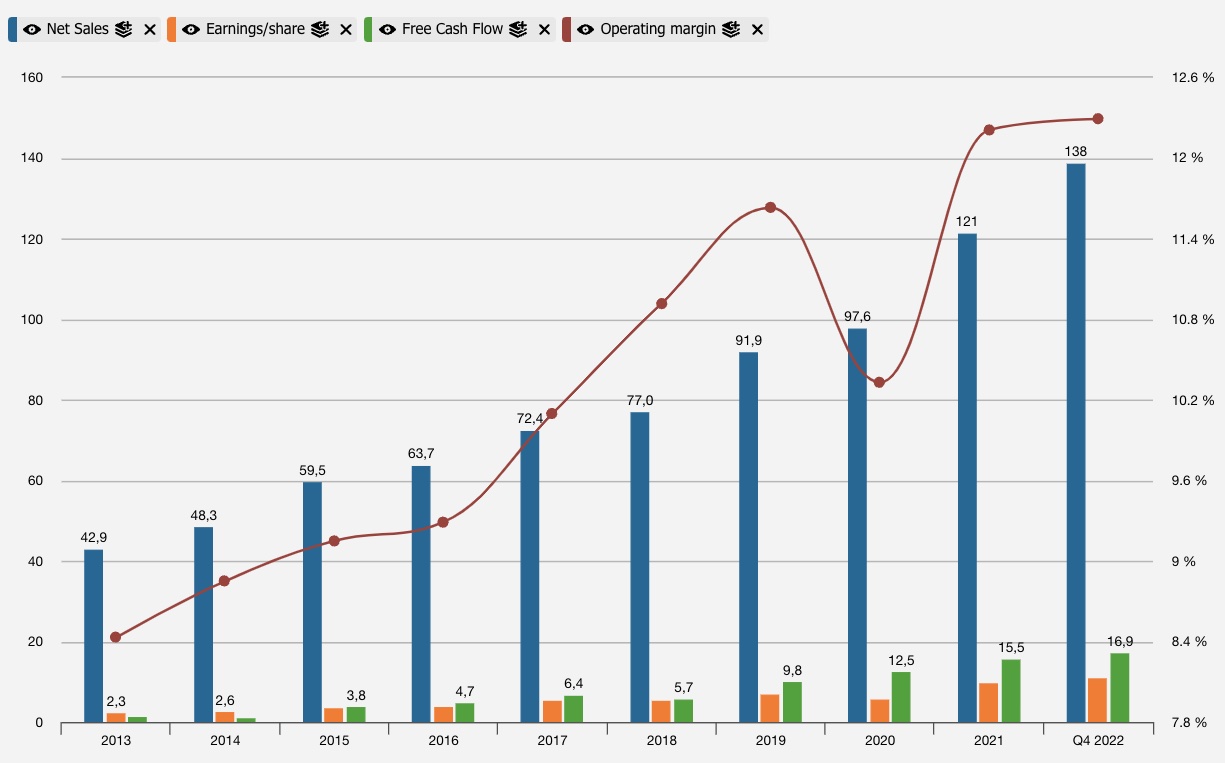

However, if we compare the share price development with the company’s operating results, we see a somewhat different (positive) story. Revenue has been steadily increasing every year for the last +10 years and so has the company’s earnings. Both in absolute numbers and per share. The company has not issued new shares, nor has it significantly increased its debt, which currently stands at 1.4x equity.

Looking at the company’s key figures, they have both currently and historically had a reasonable return on invested capital (ROIC) of 8-10% and a return on equity of around 15%. Stable and quite decent returns without being flashy.

Without diving into a full valuation, the company looks relatively cheap. Both in absolute terms with an Enterprise Value to EBIT (EV-to-EBIT) ratio of 9.9 and relative to the company’s historical ratios with an Enterprise Value to Sales (EV-to-Sales) of 1.2 versus an average of 2.1 over the past ten years.

The management apparently also finds the shares undervalued at current levels and has launched a buyback program of up to EUR 500 million at the beginning of August 2023. EUR. of treasury shares until the end of 2024, which corresponds to approximately 7% of the company’s market cap.

There could be many reasons for the very significant drop in the share price, but the most obvious in 2023 is Teleperformance’s offer to buy its competitor, Majorel Group Luxembourg, for €3 billion. EUR back in April. Teleperformance has offered EUR 30 per share, which is approximately 50% above the average share price in the month leading up to the announcement of the offer. At Teleperformance’s current share price, this is almost half of the company’s own value, so it is a very material acquisition.

Computacenter & Ubisoft

The other two new additions to the portfolio are the British company Computacenter and the French gaming company Ubisoft. Computacenter (as the name suggests) provides IT infrastructure services and advises organizations on IT strategy and infrastructure management, among other things. Ubisoft is a major international game developer for mobile, platform and PC.

Both companies have seen significant drops in their share price over the past year, with Computacenter down 16% and Ubisoft down 36%.

Other portfolio

Looking down through the portfolio, there have been no other major changes. Tweedy has divested some of French Safran, which produces aircraft engines, and British BAE Systems, which is in the arms and defense industry. The share price of both companies has risen around 30% over the past year, so it looks like they’re taking some profits.

Finally, it’s worth noting that Tweedy’s acquisition of a stake in UK-based Unilever (+300% in the quarter) is really just their sale of a similar position with the US listing of Unilever.

Portfolio:

Tweedy Browne Internation Value Fund

External source:

https://www.teleperformance.com/en-us/