As previously described

on this site

, you don’t have to find new unique investments to generate a good return. On the contrary, there is a true goldmine of knowledge and investment ideas hidden in studying the best investors in the world. Below you will find a selection of the most interesting purchases and sales in Q3 2021, which were published in the period October 20 – November 18, 2021.

You can find all the updated portfolios

here

.

Warren Buffett's biggest investment is... Berkshire

The vast majority of Buffett’s portfolio is unchanged in Q3 2021, and again this quarter he sold more than he bought. The total purchase in the equity portfolio was approximately €1.4 billion. USD 3.4 billion, while he sold for approximately USD 3.4 billion. USD. The largest purchase is an increase in the investment in energy company Chevron Corp. by 24%.The company now accounts for approximately 1% of Berkshire’s total equity portfolio. In addition, Buffett chose to trim his positions in cable company Charter Communications by ~20%, pharmaceutical company AbbVie Inc (~30%) and payment company VISA (~4%). However, the companies are relatively small positions in the context of Berkshire’s overall portfolio (0.5% – 1% each).

What’s most notable about the most recent quarter is that Buffett has continued the massive buying of his own shares. Berkshire’s third-quarter results show that the company bought back its own shares for no less than 7.6 billion euros. This is more than the 6.0 and 6.6 billion USD. USD in the first two quarters of the year. Af the company’s 10-Q we can see that purchases have continued into the fourth quarter with $1.8 billion worth of purchases in October. Barron’s also comments on this on November 8, 2021:

“Berkshire should buy back about 4% of its shares this year. The company is essentially plowing all of its operating profits into buybacks.”

In other words, Berkshire is on track to break last year’s buyback record of USD 24.7 billion. Berkshire prefers to buy back its own shares rather than pay a dividend that shareholders have to pay taxes on. Despite the massive share repurchases, Berkshire’s cash position grew from $144 billion to $100 billion. In the last quarter, the company increased its revenue to USD 149 billion. USD in the third quarter. This gives Buffet ample opportunity to continue or increase repurchases in the future. That is, without spending any of its huge cash reserves.

If we look at it in relation to the size of the company, it is equivalent to Buffett buying no less than 5% of Berkshire in 2020, and it looks like it will be in the same order of magnitude in 2021. For existing shareholders, this basically means that they now own 10% more of the company than they did in 2019. Without having to take a penny out of your pocket or pay tax on the amount.

BRK.B Chart

by TradingView

If you’re looking for a company with a high degree of robustness and an annual growth rate of around 7-10%, Berkshire is a good choice. In a bear market with major price declines, Berkshire could use a large portion of its cash reserves to buy new companies for the portfolio or buy back more of its own shares, keeping a hand under the share price. It should be added that Buffett only has a habit of buying back his own shares when he believes they are undervalued – and then, of course, when there are no other better investment opportunities in the market.

The primary metric – and the one Buffett talks about publicly – is the Price to Book ratio. Because the assets in Berkshire are quite defensively valued, a P/B below 1.4 in Buffett’s terminology would be below fair value. The P/B at the end of November 2021 is 1.34, which indicates the price is slightly below fair value. In an otherwise quite expensive market, it may therefore be a sensible time to buy or increase your position in the company.

Klarman buys Dropbox and sells out in eBay

One of the interesting new acquisitions in Q3 2021 is Seth Klarmann from Baupost Group, who bought a relatively large position in Dropbox in the past quarter. So large, in fact, that in just one quarter it represents almost 3% of the total equity portfolio.

This means that Klarman has bought at an average price of around 31 USD/share. Looking at the stock today (Nov. 28, 2021), it is now trading at around 24, or about 30% below the price Klarman was willing to pay.

DBX Chart

by TradingView

Klarman’s approach to investing is very risk-oriented (after all, we are talking the man whose investment book is titled “

Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor

” ), therefore it is reasonable to expect that there is significantly more upside than downside with the current price.

Dropbox is undergoing a transformation from a pure cloud storage service – the one most of us are familiar with – to a broader range of services. Of particular interest are their e-signature and document sharing services. That said, Dropbox’s future earnings are uncertain, especially given their strategic focus on consumers and small and medium-sized businesses. In addition, many of the services they offer are highly competitive (think Google Drive, Microsoft OneDrive, and Apple iCloud) and it can be difficult to differentiate yourself and get the necessary customer lock-in.

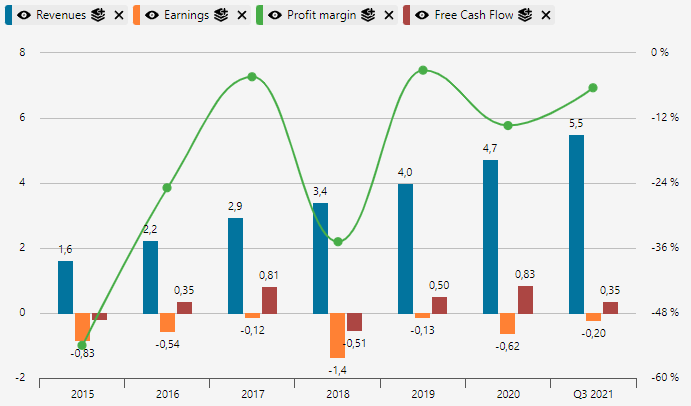

If we look at the overall picture for the company, we can see that over the past 7 years Dropbox has increased revenue between 15 and 40% each year. Similarly – albeit somewhat more fluctuating – earnings have increased over the period and turned from a loss to a profit in the last two years. The profit margin has thus continuously improved and is now approaching 0% (the green line below). The consensus forward Price to Earnings (P/E) for the next 12 months is 15.90, which is fairly cheap compared to the vast majority of US tech companies with similar growth.

Following the release of Dropbox’s third quarter results, Malik Khan of Morningstar writes in his company analysis:

“In an increasingly digitized world, we believe that Dropbox is amid a transition from a cloud-storage pure play to a more holistic content collaboration platform. With acquisitions in the high-growth e-signature and document-sharing spaces, we believe no-moat Dropbox’s pivot away from cloud storage could provide the firm with economic tailwinds.”

Dropbox will be an interesting company to follow going forward.

In addition, Klarman has reduced several of its largest positions – primarily in Intel (by 9%), Qorvo (5%) and eBay by no less than 59%. Klarman bought the position in eBay between Q4 2018 and Q1 2019 at a price around 30-35 USD per share. The stock is currently trading at around USD 75. So it looks like Klarman is taking home some profit after doubling his money in about 2 years or 50% return per year. Not bad at all.

Full transparency: At the time of writing, the author or his/her close associates have invested in Berkshire Hathaway and Intel. The author has no positions in Dropbox, eBay or the other companies mentioned in the article.