The first investment book I read was Benjamin Graham’s The Intelligent Investor. But this is not where my journey began. In connection with the IPO of the company I used to work for, I helped write the prospectus that was to be sent to potential investors. But as my knowledge of the stock market was limited to say the least, I set out to learn more about the subject.

One evening while surfing the web, I came across a podcast called The Investors Podcast. There weren’t many investment podcasts to choose from at the time and it had excellent reviews on the Apple app store. And one of the two hosts was even Danish. That became my entry point into the investment world. This is where I first learned about Benjamin Graham, Warren Buffet and the basic ideas behind value investing.

Only after listening to the first several episodes, reading various websites and gathering enough courage did I order a physical copy of Graham’s classic. It was a turning point in my understanding and interest in the stock market. Graham’s explanation of the market via the slightly manic-depressive Mr. Graham. Market and his approach to risk management with Margin of Safety are so immediately right that they stuck.

“A stock is not just a ticker symbol or an electronic blip; it is an ownership interest in an actual business, with an underlying value that does not depend on its share price.”

– Benjamin Graham, The Intelligent Investor

After that, I was almost unstoppable in my quest for investment knowledge and I probably read a new investment book a week for the next few years.

At this point, most normal people would probably ask the question‘how is that possible? I have a full-time job, friends, family, sports (and a Netflix subscription).

Listen and learn

I started reading investment books in earnest after we had our first daughter. Along with a job that required a lot more than 37 hours a week, my biggest challenge was and still is that I simply don’t have enough time to read everything I want to. Fortunately, there is a solution: Audiobooks.

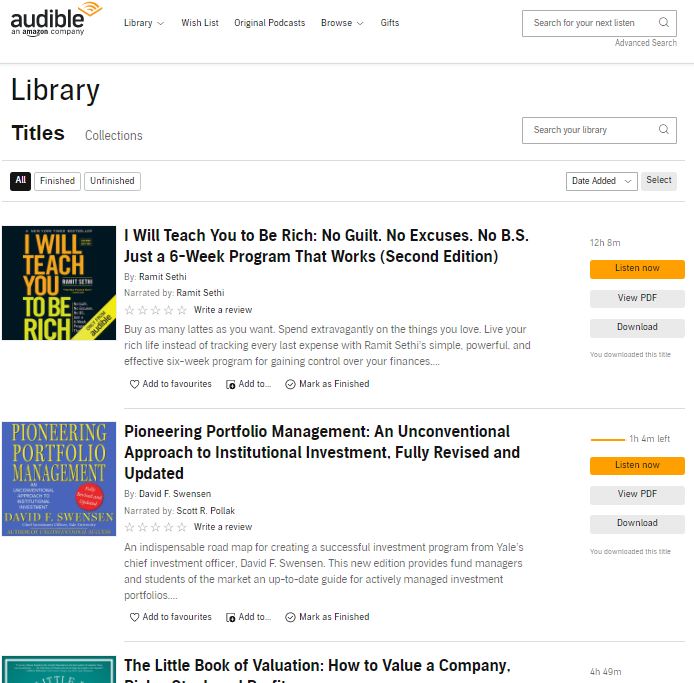

While it’s not on par with reading a physical book for me, it allows me to use my daily commute time, walks, etc. to read books. Personally, I use Amazon Audible as it is both cheap and has a very wide selection of investment books. The best books I buy afterwards and read in physical form.

When I started reading (and listening to) investment books, I didn’t have a preference for investment style. I’ve read trading books like Reminiscenes of a Stock Operator, where you can dream of becoming the next Jesse Livermore and move entire markets via your day trading. Or be drawn to the many successful investors in the Market Wizards books who have made their fortunes in everything from commodity speculation, to currency, options and real estate.

However, I quickly realized that I don’t have the interest or temperament for day trading.

Find the books that interest you

I share all of this to demonstrate that you must build your own curriculum. For example, if a book is not interesting, skip some chapters or put the book back on the shelf.

Reading has been a fundamental part of my own development. But let me be clear right away – no book (or website) can teach you everything about investing. More importantly, no book can teach you what it feels like to lose your own money.

The books I recommend on this site were all a pleasure to read. I read in my spare time and because I can’t help it.

If you need a place to start, you can find my top 5 investment books here.

In addition, I recommend checking out my list of book recommendations to see if there is something that speaks to your situation and interest.